Global Industry: Energy transition will transform mining—promise and pitfalls

We expect that demand for energy transition-related critical minerals will grow significantly in the next decades even in the absence of rapid progress required to achieve net zero. The IEA estimates that total demand for key minerals including lithium, copper, nickel, and cobalt will more than double by 2050 if the world continues with currently stated policies and increase fourfold in a net zero scenario. This represents tens of thousands of kilotons (kt) of extraction.

What you will learn:

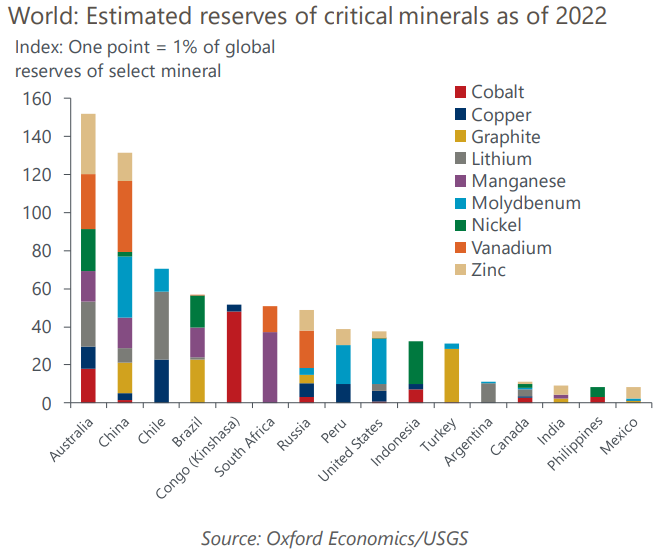

- Many critical minerals are concentrated in specific regions. Australia, China, Chile, Russia, and Brazil have high proportions of total global reserves for several key minerals, while DR Congo, South Africa, Indonesia, and others have large concentrations of one or two. Tapping into the demand for these metals could help many countries that rely on fossil fuels for economic activity to make up for declining fossil fuel related extraction.

- Indonesia has shown how countries can try to leverage a large stock of a critical minerals into wider economic gains—a ban on raw nickel exports has allowed it to locate more value-added economic activity within the country. Despite the risks of a protectionist approach, other countries will likely try to follow, but Indonesia’s combination of relatively stronger governance and an extraordinarily high share of nickel production and reserves are not easily replicable.

- There are however various downside risks: metals recycling, technological breakthroughs, and substitution could cut the potential demand increases for critical minerals. Social, economic, and environmental disruptions from mining or refining projects can also jeopardise the political consensus needed for these kinds of investments. Many of the countries endowed with large reserves of critical minerals have poor governance, poor environmental track records,

Tags:

Related Research

Post

Industry key themes 2026: Industry will grow if you know where to look

Prospects appear solid for global industry in 2026, but activity is set to remain regionally and sectorally divergent.

Find Out More

Post

Australia’s Infrastructure Outlook: Big Shifts, Bigger Challenges

Australia’s infrastructure landscape is shifting fast, driven by new investment trends, emerging asset classes and growing capacity constraints. This outlook explores the major changes ahead and what industry and government must do to navigate the decade effectively.

Find Out More

Post

Peak tariff impact on industry still to come

In 2026, we anticipate global industrial value-added output to grow just 1.9%, the slowest pace of growth since the global financial crisis.

Find Out More