Exploring the plausible ‘What Ifs’ to our 2023 China GDP forecast

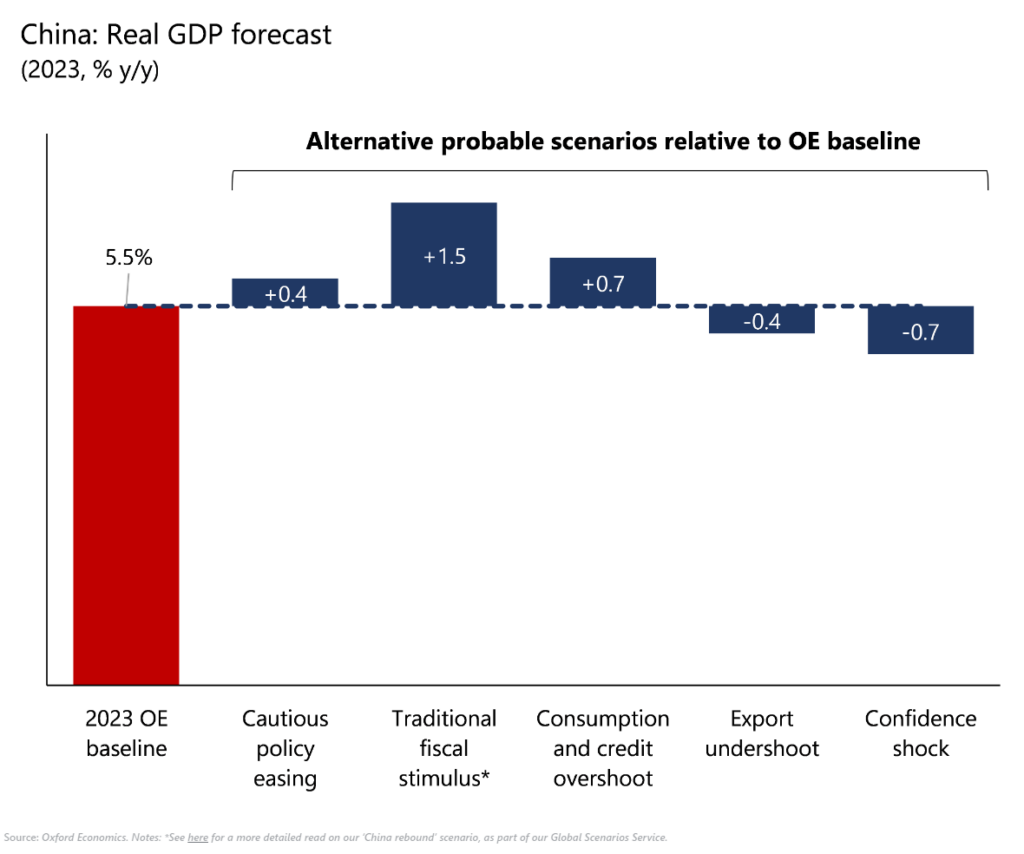

On the back of China’s recent consumption outperformance, we now expect the economy to grow by at least 5.5% in 2023. Market forecasts vary considerably, reflecting differences in assumptions around policy risk, the health of and outlook for the property sector, and the size and longevity of the reopening consumption boost.

What you will learn:

- As a thought experiment, we analysed five probable alternative scenarios using our Global Economic Model to gauge both the upside and downside risks to our 2023 outlook for China, and find a variance of around -0.7ppts to 1.5ppt to our 5.5% baseline growth forecast.

- Our analyses also demonstrate the clear limitations of policy easing, which in our downside scenarios prove insufficient to fully offset growth headwinds.

- In our base case and notwithstanding the eventual fading of a post-Covid consumption boost, growth in 2023 should comfortably exceed the official growth target. The unusual combination of a strong organic growth and still-significant economic headwinds (particularly towards H2) means that China’s monetary and fiscal policy stance could stay on hold for longer.

Tags:

Related posts

Post

A reality check on the status of RMB internationalisation

The recent geopolitical shocks and abrupt US policy shifts have heightened concerns about the stability of the dollar-centric global financial system and strengthened the perceived need for diversification.

Find Out More

Post

China and AI underpin stronger global trade outlook

Global trade is set for a stronger-than-expected rebound, supported by lower US tariffs, continued AI-driven investment, and China’s renewed export push. Our latest forecasts show upgrades to both nominal and volume trade growth in 2025–26, even as legal uncertainty surrounding US tariff mechanisms and evolving geopolitical dynamics pose risks to the outlook.

Find Out More

Post

China’s Outbound Recovery: Slowing but Still Rising

Research Briefing Exploring the plausible ‘What Ifs’ to our 2023 China GDP forecast The rebound continues, but slowing demand, economic headwinds, and shifting traveler preferences are reshaping the outlook.

Find Out More