Eurozone: New wage growth data suggest no need to delay rate cuts

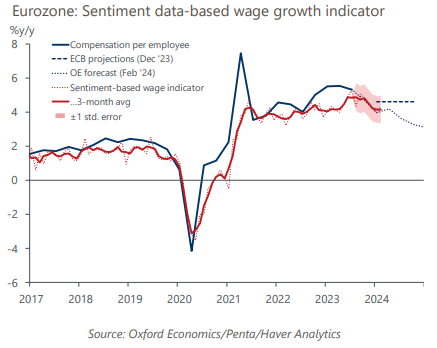

Our sentiment data suggests that the ECB’s worries about sticky inflation driven by strong wage growth are misplaced. The sentiment data-based nowcast, which allows us to track labour market developments in near-real time, suggests that pay growth continued to cool at the start of 2024 and is running below the ECB’s projections.

What you will learn:

- We think the ECB overstates the risk of sticky wages. We view current wage growth mainly as a catch up on previous real income losses and a prerequisite for a consumer recovery. The risk of sticky wage growth close to 4% y/y is limited in the medium term, in our view.

- Labour market resilience, including surprisingly strong employment growth, has propped up wage growth. But our labour market sentiment index suggests that resilience is fading, a point substantiated by falling hiring intentions. Sentiment around wage-related topics specifically is also at contained levels.

- We forecast earnings growth to slow to 3.2% by the end of the year and productivity growth gradually picking up. This will help to offset inflationary pressures from nominal wage growth, making it consistent with the ECB’s 2% target by year-end. We still expect 125bps worth of rate cuts in 2024 overall.

Tags:

Related Services

Post

Eurozone: Nowcasts show a cold start to 2024, but warming later

Our suite of nowcasting models corroborates our tepid near-term expectations for the hibernating eurozone economy, indicating Q1 growth will come in at 0.1% q/q. This is a touch below our 0.2% q/q baseline forecast, though the spread of results across our models plus mixed signals from latest data highlight the uncertainty around the immediate growth outlook.

Find Out More

Post

Eurozone: Stubborn services inflation should not delay rate cuts

A slower fall in services inflation will partially offset the relatively stronger disinflationary forces in goods prices. We do not think it will derail European Central Bank rate cuts this year, but the pass-through of strong wage growth from the tight labour market poses upside risks

Find Out More

Post

Eurozone: Monetary loosening will boost growth – but not until 2025

After the sharp falls in eurozone inflation recently, a series of rate cuts this year by the European Central Bank is now the consensus view. However, monetary policy transmission takes time and we don't think growth will receive much of a boost from monetary loosening until 2025, though there's potential for some upside surprises.

Find Out More