Eurozone key themes 2024 – A fragile recovery will gain impulse

After a year of stagnating activity, the eurozone economy will continue to struggle to gain traction in the near term given multiple headwinds. But we expect a gradual recovery in 2024 that will gather momentum as consumers regain some of their lost purchasing power and financial conditions ease.

What you will learn:

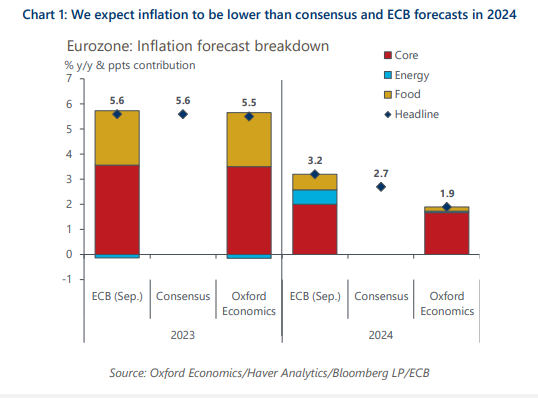

- Inflation will fall faster than the market and the ECB expects. This means we expect the European Central Bank will cut rates more aggressively than the market anticipates.

- Following the current weak patch, easing financial conditions, a recovery in consumers’ real incomes and strong household balance sheets, improved global demand, and a cyclical upswing in industry will lead to stronger growth in the second half of 2024.

- Fiscal policy will represent a rising drag to growth, as government priorities shift from providing support to deficit reduction.

Tags:

Related Posts

Post

UK Key themes 2024 – Tight policy settings weigh on growth

The UK's house price correction has been mild so far and recent data has indicated the market may be more resilient than we had thought. But we still think the downturn has some way to run.

Find Out More

Post

Lower inflation will allow rates to fall faster in EA than US/UK

We expect widespread declines in inflation and interest rates in 2024 across advanced economies. A key differentiator, however, is that the eurozone is likely to see a faster return of inflation to target and a sharper fall in interest rates than the US and UK.

Find Out More

Post

Global Key Themes for 2024 | Beyond the Headlines

It's widely believed that global growth and inflation will slow in 2024 and that advanced economy central banks will begin to pivot in H2. In this week’s Beyond the Headlines, join Ben May, Director, Macro Forecasting and Analysis, as he outlines the three key themes which we believe will have an important bearing on the precise path the economy and financial markets will take next year.

Find Out More