Eurozone: Corporate profit margins have further to fall

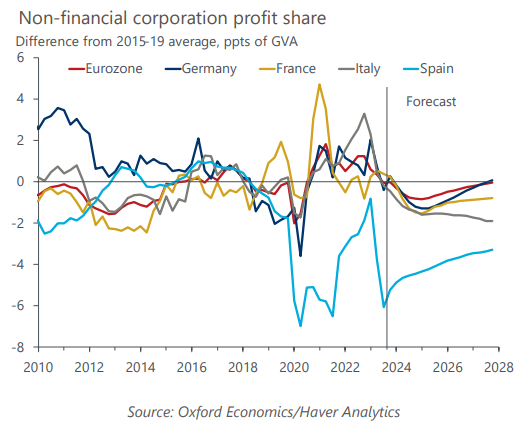

Profit margins in the eurozone have largely dropped back towards their long-term pre-pandemic average, after they increased faster than wages during the post-pandemic rebound. But we think margins will narrow further as wages catch up to inflation and productivity remains weak.

What you will learn:

- Tight supply had created shortages and an opportunity to raise margins, but the constraints have now shifted to demand, especially in the manufacturing sector where profits are still elevated. This sector has benefitted from sectoral supply-demand imbalances, though traditional profit margin indicators tend to overstate the extent of profit taking behaviour when input prices rise sharply.

- Meanwhile, profits in services are below their long-term average due to stronger wage increases.

- These trends are similar across the main eurozone economies. Spain stands out as the only major economy where profit margins are markedly below their long-term level, while the French services sector is also experiencing record low profitability.

- In the near term, we expect further compression of profit margins, offsetting the impact of high wage growth on inflation. A further drop in profits is consistent with the current weakness of the eurozone economy, as well as with the latest surveys.

- Given the subdued demand environment, we don’t think companies will be able to raise prices enough to stabilize their profit margins. Instead, corporates may try to defend their profit margins by limiting wage increases and reducing employment. This would result in weaker consumption and a softer rebound in eurozone growth than we currently forecast.

Tags:

Related Posts

Post

Europe: City employment growth eases, but office sectors still lead

Labour markets in European cities have shown remarkable resilience over the last few years, and employment in office-based sectors especially so. But from this year onwards, we expect the pace of office employment growth to slow.

Find Out More

Post

Europe: Accounting for climate transition risk in CRE required returns

We are adding a depreciation risk premium that incorporates climate transition risk to our required returns framework.

Find Out More

Post

Europe: Residential opportunities have a northern bias

The outlook for European residential real estate is improving. The prospect of lower interest rates means house price corrections are probably coming to an end, while still-stretched affordability will support rental demand.

Find Out More