Eurozone: Core goods disinflation should prompt rate cuts next spring

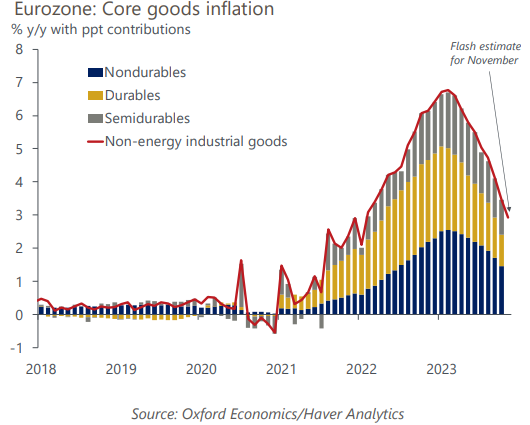

Weak demand, profit margin compression, easing pipeline pressures, and abating supply bottlenecks mean we see core goods inflation strongly coming down in 2024, supporting our below-consensus inflation forecast.

What you will learn:

- Non-energy industrial goods were the key driver of the surge in core inflation throughout 2022. While services disinflation will be stickier, weak growth will help drive down goods prices. This is particularly the case for durable goods as demand for these moves closely with the business cycle, which is further compounded by tight monetary policy as durable goods consumption is highly interest-rate sensitive.

- Strengthening supply and weak demand will ease pipeline pressures facing firms by further resolving post-pandemic supply-demand imbalances. Reduced firm pricing power is forcing firms to accept narrower margins in exchange for retaining market share. Retail firms’ assessment of stock levels are back in line with pre-pandemic levels.

- Margin compression means the catch-up in nominal wages should not fuel a wage-price spiral as firms will be under pressure to absorb higher wage costs into profits. Strong wage growth is prominent in nondurable goods-producing sectors but it displays a weak relationship with final prices, reducing the scope for wage passthrough and helping nondurable inflation ease.

- Weak core goods inflation could help push core inflation close to target by mid-2024, allowing the European Central Bank to cut rates as early as April, a view which markets have moved closer to us in recent weeks. But the exact timing and pace of rate cuts remains uncertain given the prevailing fears about underlying price pressures, a desire to be cautious following a large inflation overshoot, and deepening divisions within the council.

Tags:

Related Posts

Post

Eurozone: Why consumer spending is stuck in the doldrums

We expect weak consumer spending in the eurozone to persist throughout 2023 and into early 2024. Consumption has mainly been held back by high inflation and falling real incomes in the last 12 months, but we think tight monetary policy has now taken over as the main drag on household spending.

Find Out More

Post

Eurozone inflation undershoot to spark ECB rate-cutting in 2024

We expect eurozone inflation will fall below the European Central Bank's target in H2 2024. This is one of our key out-of-consensus views that puts us below the ECB's forecast. Our call relies primarily on more pronounced disinflation from consumer energy and food prices than the ECB assumes. We anticipate a stronger slowdown in core inflation, given our weaker growth outlook.

Find Out More

Post

Eurozone bank profits surge, but doubts about the outlook remain

Our estimates suggest that the surge in aggregate bank profitability may continue in the near term, but the outlook remains very uncertain and subject to downside risks.

Find Out More