Europe: medium-term cities outlook improves after a tough few years

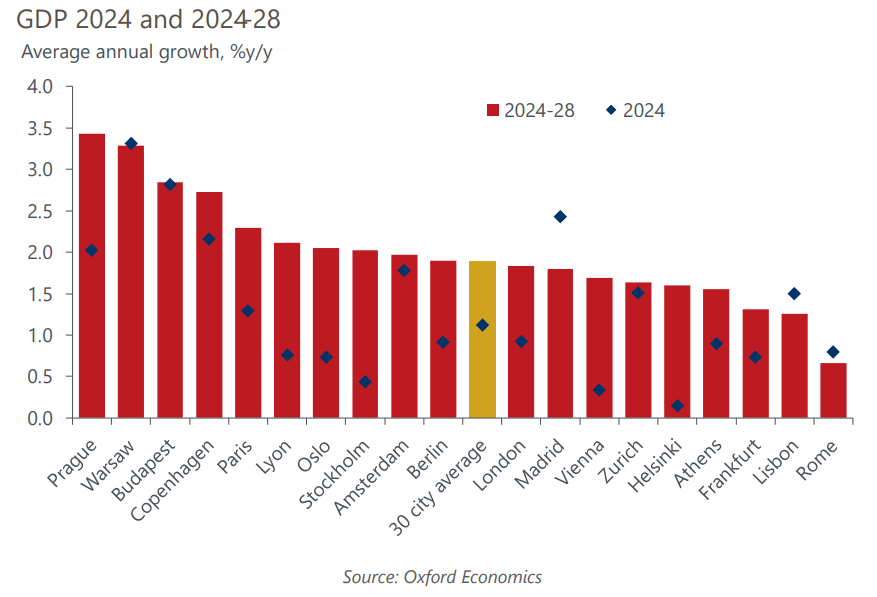

The short-term outlook for Europe’s largest cities remains subdued, but as the current pressures ease the medium-term picture is set to improve. We expect GDP growth to pick up pace from 2025 onwards and settle at 2.1% on average through to 2028. This will still be weaker than in the years preceding the pandemic.

What you will learn:

- Cities in central & eastern Europe will continue to be the fastest growing, led by Prague and Warsaw. Inward investment is set to support rising productivity, and this will be a key driver of GDP growth going forward as demographic pressures continue to weigh on the labour market.

- Copenhagen, Stockholm, and Oslo are also set to perform reasonably well over the next five years, after a difficult couple of years which have hit Stockholm the hardest. The medium-term fundamentals for these cities remain strong, and economic gains will be supported by healthy demographics and job growth. There is a similar story for Amsterdam and Lyon, which are set to be among western Europe’s strongest performers.

- Paris is set to outperform London over the coming years, but this partly reflects a delayed recovery in the French capital following a disappointing 2022, but also the UK’s broader economic challenges, including Brexit and government austerity policies.

- Among the weakest performing cities are Zurich and Frankfurt, two of Europe’s major financial hubs, where growth is being weighed down by struggles in the financial sector (a factor also at play in London). But it is southern European cities like Lisbon and Rome which will be slowest growing over the medium term, partly constrained by their weak demographics.

Tags:

Related Posts

Post

Europe: City employment growth eases, but office sectors still lead

Labour markets in European cities have shown remarkable resilience over the last few years, and employment in office-based sectors especially so. But from this year onwards, we expect the pace of office employment growth to slow.

Find Out More

Post

Europe: Accounting for climate transition risk in CRE required returns

We are adding a depreciation risk premium that incorporates climate transition risk to our required returns framework.

Find Out More

Post

Europe: Residential opportunities have a northern bias

The outlook for European residential real estate is improving. The prospect of lower interest rates means house price corrections are probably coming to an end, while still-stretched affordability will support rental demand.

Find Out More