Emerging credit opportunities in global CRE markets

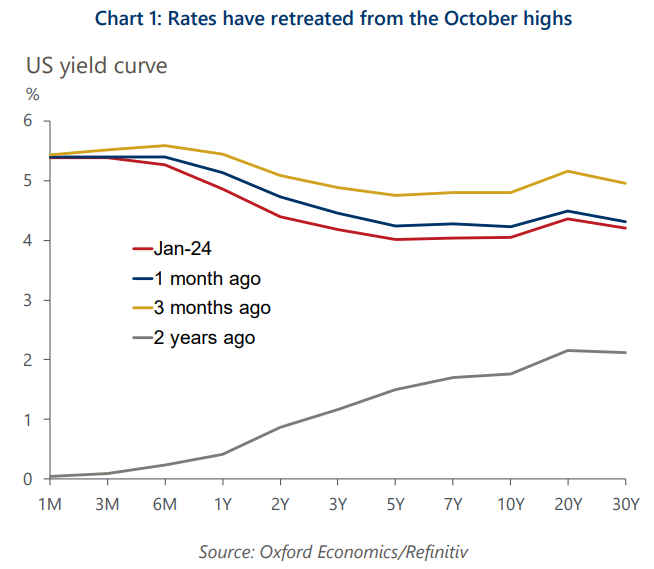

The commercial real estate landscape has undergone considerable changes due to the recent surge in interest rates and emerging funding gaps. Banks have heightened their risk assessments, leading to a noticeable reduction in their loan-to-value ratios.

Despite these tighter lending conditions, there remains consistent demand for borrowing, particularly for refinancing existing debts, as well as for capex finance. We think opportunities are likely to build over the year as debt maturity volumes intensify.

What you will learn:

- Policy rate hikes and downward pressure on CRE values continue to impact credit availability across most major markets. This has led to the emergence of funding gaps in segments of the capital stack, which is creating both challenges and opportunities for lenders.

- Banks have tightened their lending criteria and are being hamstrung by the covenant breaches and loan migration within their existing loan books. This is creating opportunities for nontraditional lenders like private credit providers to fill the void with innovative lending solutions.

- Credit returns have improved following both interest rate hikes and margin expansion. The illiquidity of higher risk development finance and hybrid structures also has added an additional level of support for those seeking to deploy credit.

- We have strong conviction on specific credit strategies, including the provision of junior notes, flexible stretched senior loans, capex credit and hybrid strategies. Higher risk credit strategies will be need in order to not create supply shortfalls in high growth areas such as data centres and residential markets.

Tags:

Related Posts

Post

Amid disruption, what can US office learn from retail?

We examined the disruption of generative AI at the US county level. We identified several metros – Atlanta, Denver, New York, San Francisco, and Washington DC – that had at least one county with the highest percent of displaced workers from AI.

Find Out More

Post

Four themes are shaping US real estate markets

This year is set to be a turning point for commercial property markets in the US. A gradual easing of inflationary pressures alongside a steady, if unspectacular, year for GDP and employment growth should help to ease the market through the final leg of the post-Covid adjustment. But there are four important themes market participants will need to understand to navigate the short and medium term successfully.

Find Out More

Post

Promising trends signal optimism for the hotel sector

The global travel recovery took great strides in 2023, with some destinations already reporting a full recovery back to pre-pandemic levels. Trends continue to suggest further growth in tourism activity going into this year, signalling optimism for the hospitality sector going forward. But risks stemming from inflation, geopolitical tensions and climate change will persist.

Find Out More