Dumping? Key categories of Chinese imports have surged in Europe

China has been accused of dumping stock onto the European market within the automotive, metals and chemicals sectors with the possibility of the EU placing tariffs on these products. Dumping is defined as a company exporting at a price lower than its domestic price and requires greater evidence than just a surge in imports, which will take time to gather and assess.

What you will learn:

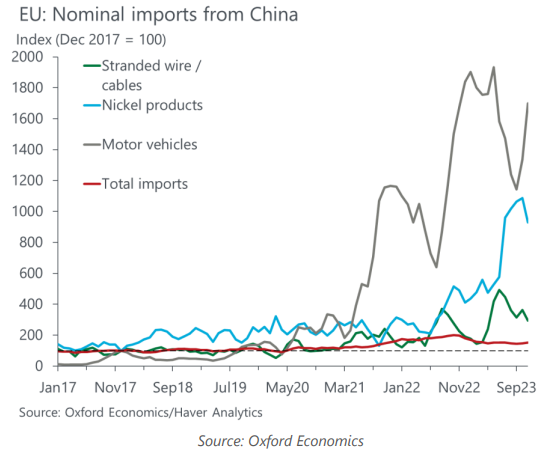

- In 2023 (YTD), as total nominal imports into the EU from China decreased by 23%, purchases of Chinese goods in a few select categories surged dramatically. These include motor vehicles with car chassis (+327%), metal products such as steel alloys (+100%) and chemicals like biodiesel (+24%).

- Recent weakness in China’s economy meant that domestic demand for China’s stock could not keep pace with supply leading to the rise in exports which has been helped by a year of deflation, making Chinese exports more globally competitive.

- The trajectory for EU imports from China could go in either direction depending on what is driving this surge. If China really is dumping into Europe, imports at this elevated level could persist. However, if the surge was responding to destocking due to a weak economy, exports could recede.

- Drawing a concrete conclusion will require further trade data up to mid-2024 to see how China’s industrial performance and domestic demand continue to play out after a weak 2023.

Tags:

Related Services

Post

Acceleration in digitalisation will keep a service trade deficit in Japan

We project Japan's services trade balance will remain in deficit over the coming years as a trend increase in the import of digital-related services will outweigh a rising travel services surplus that has been driven by inbound tourists.

Find Out More

Post

The cost of US-China decoupling

Trade protectionism between the US and China has been intensifying over recent years, and this is increasingly raising concerns of an adverse economic fallout among businesses. In our latest Techonomics Talks, David Schockenhoff, Head of US Macro Consulting, examines these concerns and the potential economic fallout.

Find Out More

Post

China: Consumption bounce ≠ surging goods imports

Unlike past recovery cycles, the sharp expected rebound in China's private consumption may not result in surging imports. Our updated forecast now sees 8% plus consumption growth in 2023, much of it will be frontloaded, with the sequential quarterly pace winding down by year-end.

Find Out More