Czech Republic: Normalised savings will lift, not turbo-charge consumption

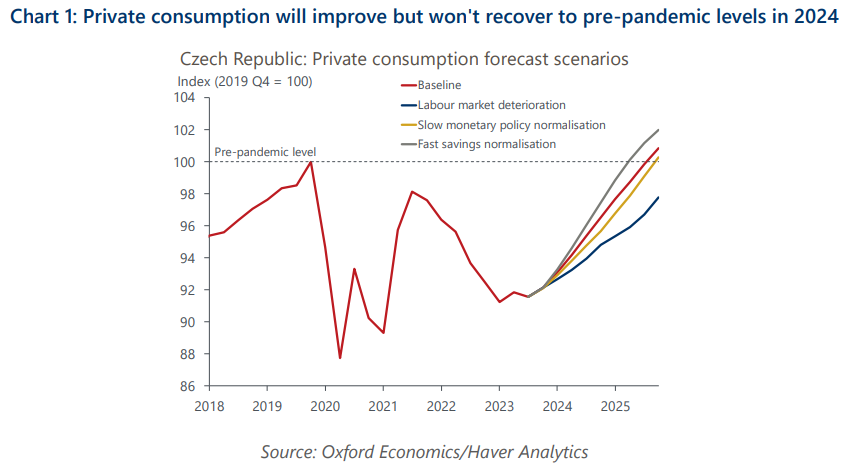

A plunge in consumer spending in 2022-23 has been a key factor behind the poor performance of the Czech economy. A recovery in consumption hinges on households normalising their elevated savings rate. We think this will be a gradual process, closely tied to monetary policy normalisation.

What you will learn:

- We think the recent rise in households’ savings rate was mainly due to the sharp rise in interest rates which makes savings more attractive. Weak confidence or precautionary motives have played a smaller role.

- A simple return of the savings rate to the pre-pandemic average could be a strong boost for consumption, though insufficient on its own to fully recover lost consumption. Also, households’ saving and spending decisions don’t happen in isolation, and wider economic conditions aren’t conducive to splurging.

- This is why we are sceptical about a rapid normalisation in savings. Although we think the central bank will have to catch up next year, policy rate normalisation will be sequential. Similarly, even as real earnings resume growing, uncertainty is unlikely to dissipate – if anything, deteriorating external demand and growing cracks in the labour market suggest the opposite.

Tags:

Related Posts

Post

Eurozone Outlook improves, but not enough to avoid a contraction

A string of positive high-frequency data and an upside surprise in the flash GDP estimate for Q4 2022 have prompted us to raise our eurozone growth forecast. Economic growth has managed to stay above expectations, and with the easing in gas and oil prices, the most severe downside risk has been removed. That said, our baseline still features a contraction in Q1, and the recovery in H2 could underwhelm if the impact of monetary tightening turns out stronger.

Find Out More

Post

Inflation – not past the peak and easing will be gradual for France

France has dodged soaring price pressures better than its eurozone peers, but we think its inflation will fall more slowly.

Find Out More

Post

Several European cities may manage to defy recession in 2023

After a mixed 2022, with post-pandemic recovery driving strong growth in the first half of the year, a recession over this winter means that we expect average 2023 GDP growth for European cities to be close to zero.

Find Out More