Research Briefing

| Apr 16, 2024

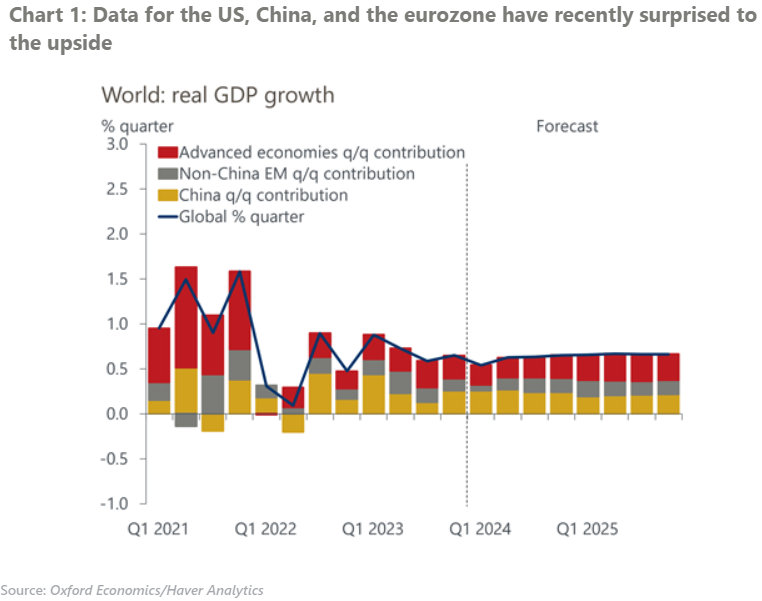

Commodities: Strong advanced economy demand boosts prices

What you will learn:

- Brent crude has risen to $90pb as resurgent demand and geopolitical uncertainty drives bullish price action. We forecast a moderate decline in oil prices from Q3 onwards with Brent closing this year at $80pb.

- Precious metals prices rallied last month, with gold reaching multiple all-time highs. Strong structural demand forces created a very supportive environment for gold, with EM central banks, Chinese consumers, and money managers the biggest buyers of the metal recently. We’ve raised our outlook in the short term, but think that the rally has run out of momentum.

- We’ve cut our iron ore price forecast after a sharp fall in March. We’ve raised all our H2 2024 steel price forecasts marginally as we expect the global industrial cycle to slowly improve.

To learn more about our price forecasts for base metals, precious metals, battery raw materials and food, please submit the form to download the full report.

Tags:

Related Reports

Post

Commodity Key Themes 2026: Softer oil prices and firmer metals

In this report, we outline five key themes that will shape the global commodity landscape in 2026.

Find Out More

Post

Commodities outlook 2026: Another challenging year ahead

Looking ahead, we anticipate a modest contraction in 2026 for aggregate commodity prices, with US natural gas and precious metals likely to remain relative outperformers.

Find Out More

Post

Policy-driven volatility ahead for critical metals

Industrial strategy, not scarcity, has become the new source of commodity price turbulence.

Find Out More[autopilot_shortcode]