China decoupling starting to gather pace

The latest evidence suggests that the economic ‘decoupling’ of China from the west is starting to gather pace. Decoupling is yet to become globally widespread on the trade side but is increasingly evident in relations with the US. Foreign direct investment (FDI) trends and surveys of China-based Western firms suggest decoupling is likely to be increasingly visible over the coming years.

What you will learn:

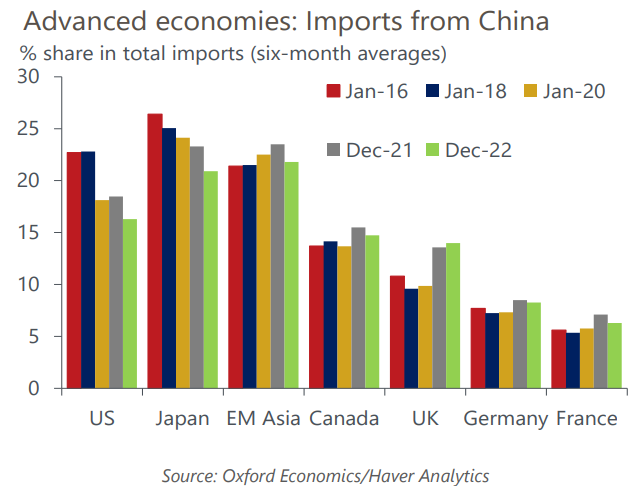

- The share of US imports coming from China has resumed its downward trend after briefly recovering during the pandemic. Chinese industries hit by US tariffs have particularly suffered, with US imports from these sectors perhaps 40%-50% lower than they would have been in the absence of tariffs. Besides the US, evidence of trade decoupling is harder to find.

- The US electronics market has shifted decisively away from Chinese suppliers. US restrictions on semiconductor trade with China are starting to bite with US exports to China more than halving since early 2022.

- Trends in FDI, especially greenfield FDI, are likely to be a good indicator of trade trends in the future. Notably, FDI inflows into China have slowed sharply over the last two years, with greenfield inflows in 2022 at just a quarter of the level of a decade ago.

- Surveys of firms in the US and Europe point to a notable rise in interest in relocating some investment and activity outside of China. A deterioration in their perception of China as a market is a key factor, linked in part to geopolitical tensions. The main likely locations for relocations are elsewhere in Asia, but interest in ‘reshoring’ to the US also seems to be on the rise.

Tags:

Related Posts

Post

China drives its way up EV exporter rankings

Global electric vehicle (EV) trade has grown undeterred in the last five years—increasing at a compound annual growth rate (CAGR) of 50.4% between 2017-2021—as multiple nations and regions encouraged EV adoption as means for meeting long-term climate change targets.

Find Out More

Post

US supply chain stress unwinds heading into year-end

The easing in supply chain stress is an encouraging sign for the US inflation outlook, but conditions continue to drag on economic activity.

Find Out More

Post

Semiconductor cycle to worsen the coming slowdown in Asia

The semiconductor cycle has already turned and is likely to continue softening into next year. As the world's largest producer of chips, Asia is set to bear the brunt of the hit to growth.

Find Out More