China coastal tech exporters vulnerable to new Trump tariff

The United States has introduced an additional 10% levy on Chinese imports as part of the opening round of the Trump 2.0 tariff regime. While certainly not as severe as some of the tariff threats made against China by President Trump in the run up to his inauguration, we nevertheless expect the additional tariffs to affect the country’s economic performance—with coastal tech manufacturing hubs particularly vulnerable.

What you will learn:

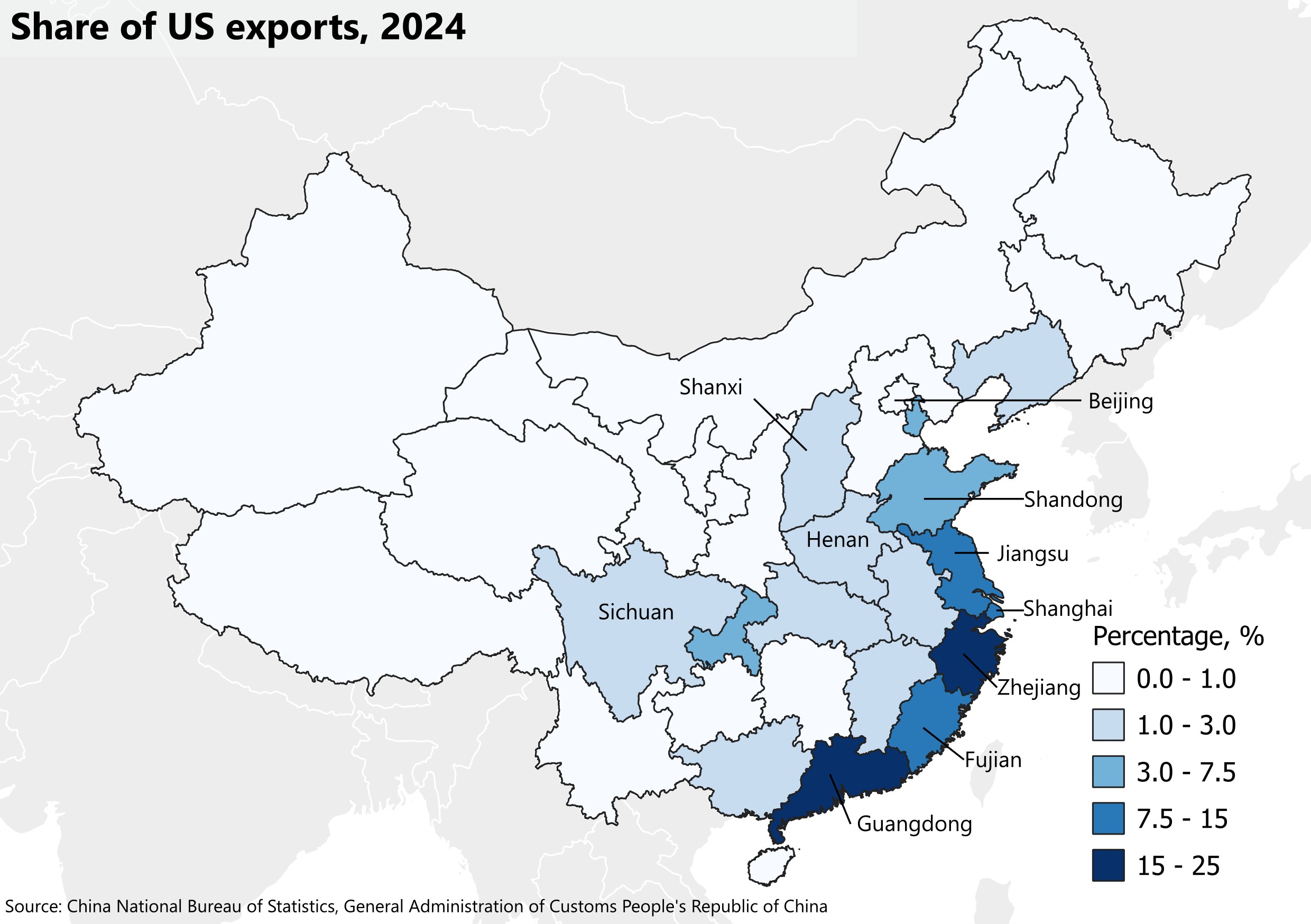

- Given the catch-all nature of the new tariff, manufacturers across goods categories and regions will likely feel the short-term pinch on production from lower US demand. However, the provinces and cities most vulnerable will be those with manufacturing bases that have higher concentrations of the largest and most important US-bound export categories, particularly electronics and apparel.

- This includes the coastal provinces of Guangdong, Jiangsu, and Zhejiang, the three largest exporters to the US and which combine to account for over 50% of all China’s exports in electronics. The central provinces of Henan, Shanxi, and Sichuan, where the US accounts for as high as 30% of all exports from those regions, are also vulnerable, as are specialist export manufacturing cities, such as “iPhone city” Zhengzhou.

- In the long term, an additional concern for China’s key export-manufacturing regions will be the hastening of supply chain diversification. Producers in China have already come under intense cost competition from cities in India and elsewhere in Asia in recent years, and new and entrenched tariffs could hasten business plans to diversify supply chains away from China. This would be a hit to cities and provinces, not only by affecting production and jobs, but also in terms of the flow of knowledge and Chinese tech competitiveness.

Tags:

Related Services

Post

The rise of Southern India’s business service hubs

Over the next five years, India is set to be one of the fastest-growing major economies across Asia Pacific, lead by the performance of its IT and business services. The Southern states of Karnataka and Telangana are at the forefront of this success as they are home to two of India’s most rapidly growing cities and productive cities—Bengaluru and Hyderabad.

Find Out More

Post

London’s productivity slump highlights Manchester’s momentum

The UK’s productivity performance has been lacklustre since the 2008 global financial crisis—both historically and relative to its international peers.

Find Out More

Post

Amsterdam outlook 2025-2029

The European economy has endured a challenging year in 2025, but we expect Amsterdam to hold up relatively well.

Find Out More