Can the banking system really rescue the property sector in China?

We are unconvinced that recent measures mark a turning point in China’s housing downturn, just as we were cautious of the efficacy of the “16-point” property support package a year ago.

What you will learn:

- The banking system can ‘rescue’ the property sector to the extent that it can reduce event or headline risk in China’s housing market, and therefore buttress activity in adjacent economic segments such as private investments and consumer spending, but it cannot ‘rescue’ the sector out of the necessary multiyear structural correction process that is underway.

- As housing struggles to find a floor, policy efforts are directed towards reinstalling confidence in private developers by alleviating ‘flow’ funding problems.

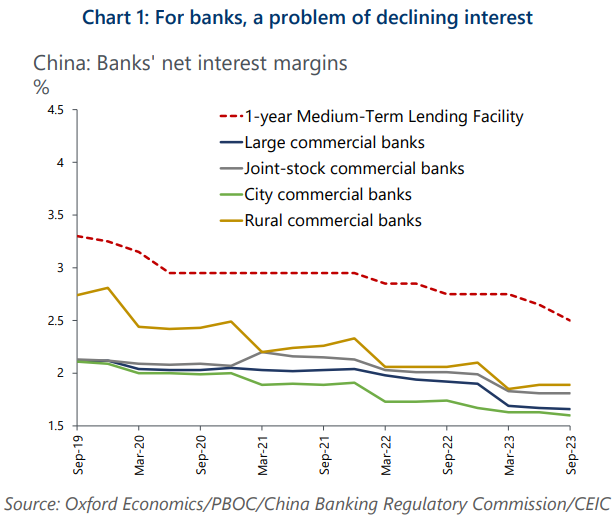

- With profitability taking a hit, large state-owned banks face the risk of further asset-quality deterioration. On the other hand, weak banks may get weaker, posing contagion risks.

- The resulting banking system is likely to be less profitable and less well-capitalised, impairing the transmission mechanism of future monetary policy. However, while the real economic impact of China’s property downturn will be sizeable and prolonged, we think ultimately, the authorities should be able to manage the downturn without it triggering a financial crisis.

Tags:

Related Posts

Post

Infographic: Key macroeconomic risks impacting global real estate performance

Continued economic growth will help stabilise commercial real estate yields and values before pricing slowly begins to recover next year. We expect global all-property total returns to average 5.3% per year over 2024-2025 in our baseline scenario. However, there are still upside and downside risks that real estate professionals should watch out for. In this infographic, we outline these risks and their impacts on property value.

Find Out More

Post

Offices globally the most exposed CRE sector to generative AI

We expect that offices will be the most exposed US property sector to the impact of generative AI by 2032, followed by life sciences and manufacturing. In contrast, the hospitality and industrial sectors look set to be the least exposed.

Find Out More

Post

US Office real estate is the bad gift that keeps on giving

Our view remains that the most severe risks in commercial real estate are concentrated in the office sector, as it continues to deal with the pandemic-induced structural shift of increased remote and hybrid work.

Find Out More