California’s economy is more than tech and entertainment

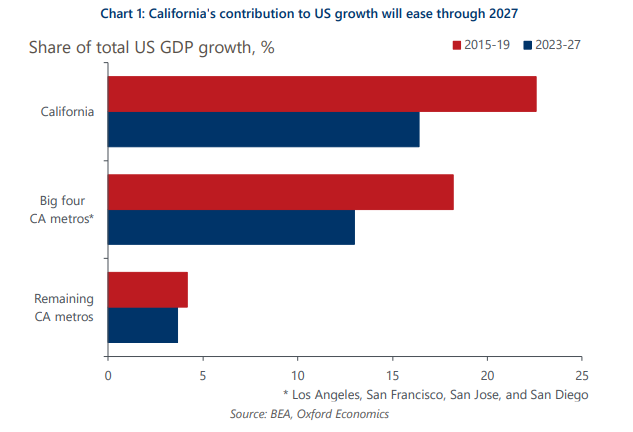

Despite strong growth in recent years, the California economy is facing multiple challenges, not least to its key entertainment and technology sectors. We forecast that the big four Californian metros will contribute a smaller share of total US growth in the next five years than in the recent pre-pandemic past. But other Californian metros will have more impact, as firms move to smaller towns, whose amenities attract graduates and families, and as other sectors maintain or increase their significance.

What you will learn:

- Los Angeles will take some time to recover from the writers’ and actors’ strikes which shut down TV and film production at a time when film production in Hollywood is facing increased competition from elsewhere. And high costs and tech layoffs are threatening the Bay Area economy with increasing numbers of firms choosing to relocate. High business costs in San Francisco and San Jose, and less restrictive regulation in Texas, are driving people and businesses alike away from Silicon Valley.

- The Bay Area remains the most expensive area in the US in which to buy a house. High living costs and wage inequality have led to out-migration while homelessness has increased. Improved quality of life elsewhere and company relocations are tempting many graduates to relocate away.

- Growth opportunities still exist, especially in smaller metros such as San Luis Obispo and Napa which will see the highest employment growth over the next five years. Hospitality-led metros and college towns will benefit from a combination of outdoor amenities, lower living costs, and graduate opportunities. Emerging industries in AI and green energy show that the California tech sector is still driving innovation. Logistics and warehousing are important in Riverside and elsewhere, while mining and agriculture also remain key industries in some smaller metros.

Tags:

Related Services

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

Global Cities Service

Make decisions about market and investment strategies with historical data and forecasts for 900 of the world’s most important cities.

Find Out More

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More