BoJ likely to look through widespread price jumps

The Bank of Japan left monetary policy unchanged at today’s meeting, maintaining current short- and long-term interest rates as we anticipated. The BoJ’s new strategy of offering daily, unlimited fixed-rate JGB purchases has been defending the +/-0.25% range for 10yr JGB, with lower purchases than previously.

The BoJ’s quarterly Outlook Report revised up the median CPI forecast to 2.3% from 1.9% for FY2022, but estimates for FY2023 at 1.4% and FY2024 at 1.3% remain short of the BoJ’s 2% target.

What you will learn:

- We share the BoJ’s view that the ongoing price increase is a one-off event driven by a sharp rise in input costs. We don’t forecast sustained inflation without support from demand, which is unlikely amid stagnant wages.

- Despite the modest overall rate, inflation is unprecedentedly widespread – particularly price rises for daily necessities. This, alongside yen weakening, was a major issue at the upper house election on July 10, although the ruling parties secured a comfortable majority.

- We still see no incentive for both the Kishida administration and the BoJ to change the current low interest rate policy through the Yield Curve Control framework. The death of former Prime Minister Shinzo Abe is unlikely to change the overall macroeconomic framework in the near future.

Tags:

Related posts

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

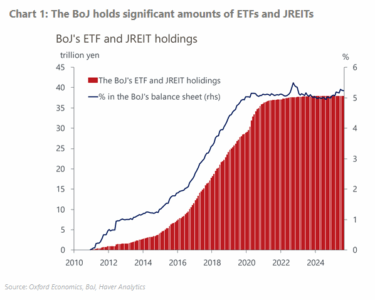

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More