Beijing’s new industrialisation gamble – will it pay off?

Beijing’s reinvigorated support for manufacturing is quite the economic gamble. With property still in the doldrums and the post-Covid services recovery having largely run its course, the rationale is that manufacturing could minimise the risk of a broader activity slowdown.

What you will learn:

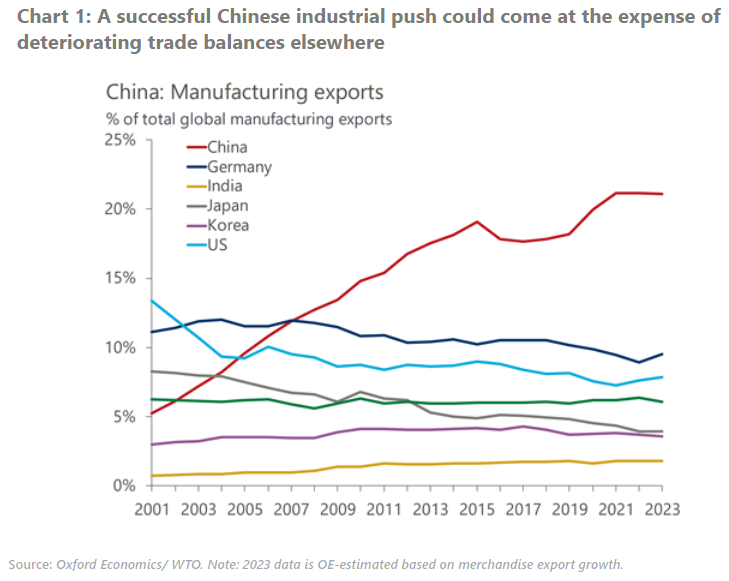

- But as demand remains tentative onshore, the natural and consequent reliance on an export-led growth strategy could worsen trade balances elsewhere, triggering more severe protectionism in retaliation. Already, momentum on that front is building across the US, EU and parts of emerging markets.

- This time around, state-favoured industries, including science, high-tech, and green sectors, have been the main beneficiaries of local lending activity, successfully translating the increased funding into increased productive capacity. In some of these industries, such as renewables and batteries, overcapacity has become an increasing risk, adding to disinflationary pressures.

- Still, macro data suggests China’s manufacturers remain highly export competitive. They are chiefly competing with regional or advanced economy peers in key export markets, reflecting an impressive range of product and cost competitiveness across the supply chain, particularly in niche areas like electronics.

- The other key difference in the current industrial policy push is that there’s likely much less upside now than in previous cycles for foreign multinationals and exporters of inputs into China’s manufacturing.

Tags:

Related Services

Post

China’s overcapacity ‘problem’ in five charts

We find emerging, but not overwhelming, macro proof to support the recent geopolitical narrative of excess Chinese goods production that unfairly undercuts global manufacturing competitors on price. Without compelling evidence in the data, there is likely no impetus for authorities to adopt meaningful course-corrective measures to rein in any perceived excess capacity problems zeroed in by Western trading partners anytime soon.

Find Out More

Post

Biden’s new China tariffs are more symbolic bark than bite

The Biden administration's additional tariffs on China are essentially a rounding error for inflation and GDP, carrying no implications for monetary policy. However, Biden’s decision to implement additional tariffs on China is another indication that US industry policy is shifting toward the stick approach, such as more use of tariffs.

Find Out More

Post

MINGTIANDI: Oversupply weighs heaviest on China’s office markets

China’s office markets have been flooded with new supply, evidenced by higher vacancies relative to other global markets.

Find Out More