Asset Allocation Key Themes 2024 – Risky assets are not out of the woods

We think risk assets will underperform in 2024. We map out the implications of our key 2024 global macro themes for asset allocation.

This research report expands on these key themes:

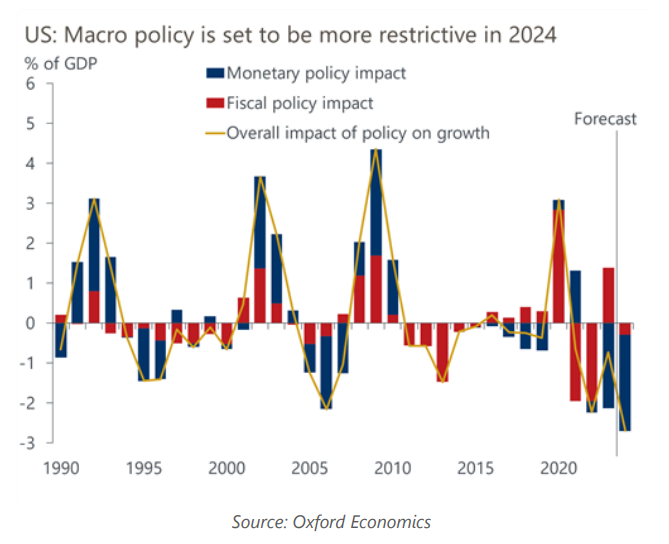

- Risks to growth are skewed to the downside. Our global growth forecasts are below consensus as we believe the peak effects of policy tightening are ahead. This supports our cautious allocations as we expect the EPS recovery to disappoint and balance sheets to come under pressure. We are underweight in high-yield (HY) credit and equities.

- Inflation trends will diverge. The eurozone will continue to experience stronger disinflation than elsewhere, fuelling our bull steepening view for core European government bonds. However, lower inflation should help pave the way for a H2 economic growth recovery and lead to rerating of eurozone small cap stocks. The term premium will continue to ease and we see US long-term real yields trading at 1%, with a range of 3.5%-4% for the nominal 10y UST by year-end.

- There are some key pockets of opportunity. We see merits in being bullish yen on cyclical and valuation grounds, but yen bulls will have to wait until H2 2024 when the global rate cycle finally peaks and the soft-landing narrative is more forcefully challenged. We think unhedged foreign investors will see decent returns in Japanese equities in 2024.

- We think the outperformance of Euro vs US HY credit will continue in 2024. A more supportive European Central Bank (ECB) next year, a rapidly narrowing growth differential with the US, and attractive valuations underpin the allure of Euro credit (relative to US) despite a larger refinancing wall in 2024.

Tags:

Related Posts

Post

Closing our short SEK trade to capitalise on the Scandi FX sell-off

We expected a bout of SEK weakness following the Riksbank rate cut in the spring, but we think the recent sell-off is overdone, and we close our long EURSEK trade, opened in May.

Find Out More

Post

Could the election spark renewed interest in UK-focused stocks?

The UK election has concluded with Labour securing a landslide victory. This result is likely to set the stage for a period of political stability and, combined with signs of a consumer-driven economic recovery, makes domestic-focused UK stocks increasingly attractive.

Find Out More

Post

Modeling the economic impact of a Democratic sweep | Beyond the Headlines

The outcome of the presidential and congressional elections this November will be pivotal for the outlook in 2025 and beyond. This week, join Bernard Yaros, Lead Economist, as he examines the impact of a potential Democratic sweep of the White House and Congress.

Find Out More