Three key idiosyncrasies in Asian trade and why they matter

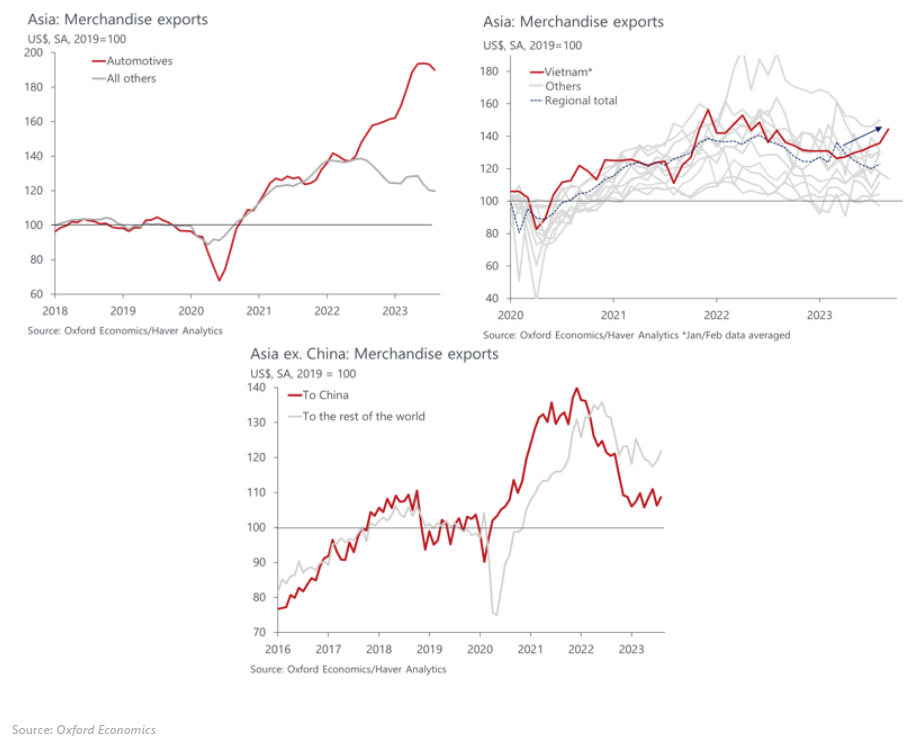

Idiosyncrasies in recent Asian trade data suggest that country-specific factors are becoming more influential and causing some countries’ exports to buck cyclical trends. If that continues, the fortunes of regional exporters will diverge further in 2024, though we still think the overall export trend will be subdued. The economic importance of export sectors in Asia means currencies, asset prices and policy could diverge accordingly. Download the report now.

What you will learn:

- The first idiosyncrasy is that automotive exports are racing ahead. That is benefitting China, South Korea, Japan, and Thailand. Some of the boost reflects pandemic-era order backlogs still being filled, which should soon fade.

- Second, Vietnamese trade is on a roll. Despite the general downtrend in electronics, Vietnam’s six-month winning streak is being driven by exports of electronics, especially to China.

- Third, while on aggregate Asian exports to China are still doing worse than exports to other countries, some countries’ exports to China are outperforming. That likely reflects the lengthening of supply chains in response to trade friction, with Asian countries “interposing” between China and the US.

- As that continues, more opportunities will be created for some exporters. Aside from Vietnam, the rest of ASEAN looks best placed to benefit.

Tags:

Related Posts

Post

Weak world trade still a drag on global growth

World goods trade declined in 2023, reversing the trend of 2022. This development points to the resumption of the decade-long pattern of slow global trade growth relative to GDP. Recent trade trends imply downside growth risks for 2024 and the longer-term outlook still looks to be one characterised by 'slowbalisation', especially with protectionism a rising issue.

Find Out More

Post

Semiconductor cycle to worsen the coming slowdown in Asia

The semiconductor cycle has already turned and is likely to continue softening into next year. As the world's largest producer of chips, Asia is set to bear the brunt of the hit to growth.

Find Out More

Post

Global goods trade to shrink in 2023

Our baseline forecast is now for world trade in goods to decline by 0.2% in 2023, a considerable downgrade from six months ago.

Find Out More