APAC’s consumption recovery will slow into 2023, but not reverse

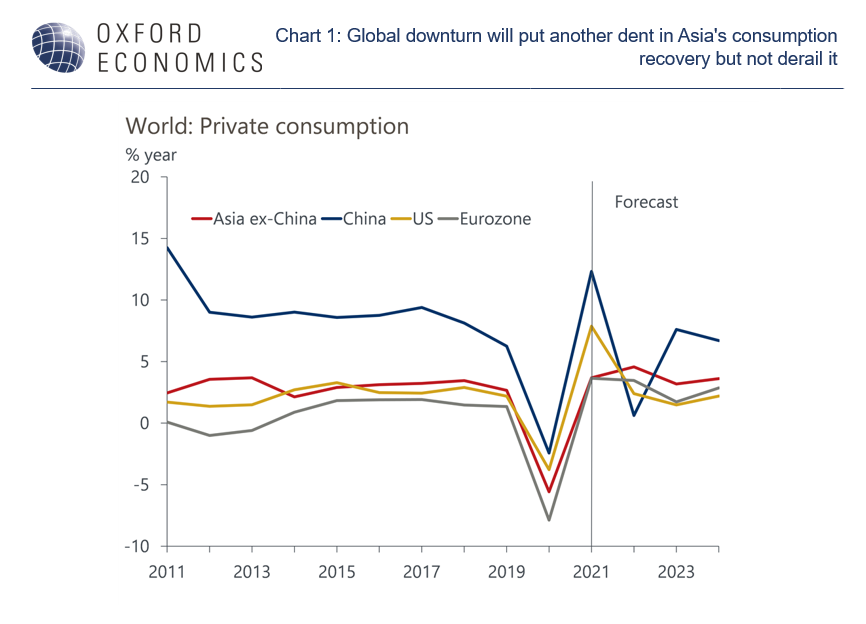

The pace of Asia’s household spending will likely lose steam from here as tailwinds from re-openings ease, real income growth slows, and sentiment weakens amid a challenging global backdrop. Within the region, we think downside pressures are more pronounces for northeast Asian as compared to India and Southeast Asia.

Still, with most of the continent finally treating Covid as endemic, we expect private consumption growth to remain resilient in 2023 and generally outperform other regions.

What you will learn:

- An important reason for our outlook is that real incomes are expected to rise in Asia in 2022 and 2023.

- With household savings rates still above pre-pandemic levels, consumers also have the scope to save less. In general, we expect savings rates to fall below 2019 levels next year.

- Finally, the policy backdrop is expected to stay supportive. While rate hikes have picked up recently, the pace of tightening is not nearly aggressive enough to cripple spending or topple growth.

- That said, we must note that growth resilience in the short term does not improve Asia’s medium-term outlook. It only prevents it from worsening. Within the region, we think downside pressures are more pronounced for Northeast Asia vs. India and Southeast Asia.

Tags:

Related posts

Post

Strong growth across the South India, but divergence risks ahead

Over the next five years, India is forecast to be the fastest growing major economy across Asia-Pacific. We expect India’s real GDP to grow on average 6.7% per year between 2024 and 2028. In general, we expect the Southern states to lead GDP growth rankings, while the Central, Eastern, and Northeastern states are anticipated to lag.

Find Out More

Post

China-India – Expanding the middle classes

Indian consumers' spending power is far behind that of their Chinese counterparts, and we are sceptical about the pace of catch-up. Even if the Indian economy achieves the ambitious growth targets set, there are few signs that record levels of income inequality will reverse soon.

Find Out More