APAC: Financial conditions appear resilient in banking sector

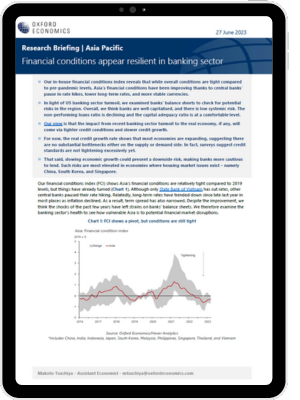

Our in-house financial conditions index reveals that while overall conditions are tight compared to pre-pandemic levels, Asia’s financial conditions have been improving thanks to central banks’ pause in rate hikes, lower long-term rates, and more stable currencies.

In light of US banking sector turmoil, we examined banks’ balance sheets to check for potential risks in the region. Overall, we think banks are well capitalised, and there is low systemic risk. The non-performing loans ratio is declining and the capital adequacy ratio is at a comfortable level.

What you will learn:

- Our view is that the impact from recent banking sector turmoil to the real economy, if any, will come via tighter credit conditions and slower credit growth.

- For now, the real credit growth rate shows that most economies are expanding, suggesting there are no substantial bottlenecks either on the supply or demand side. In fact, surveys suggest credit standards are not tightening excessively yet.

- That said, slowing economic growth could present a downside risk, making banks more cautious to lend. Such risks are most elevated in economies where housing market issues exist – namely China, South Korea, and Singapore.

Tags:

Related posts

Post

Rise of new megacities will drive global urban growth

The population of the world's 1,000 largest and most important global cities is forecast to increase by more than half a billion by 2050. However, this urban demographic growth is not equally distributed across the world's cities.

Find Out More

Post

Chinese Outbound Travel to Gain Momentum in 2024

Chinese outbound travel finally restarted in 2023. This re-opening was keenly anticipated by global destinations, given the significance of China as an outbound market. Chinese outbound travel will stride further towards recovery in 2024.

Find Out More