Eurozone: Monetary loosening will boost growth – but not until 2025

After the sharp falls in eurozone inflation recently, a series of rate cuts this year by the European Central Bank is now the consensus view. However, monetary policy transmission takes time and we don’t think growth will receive much of a boost from monetary loosening until 2025, though there’s potential for some upside surprises.

What you will learn:

- Looser financial conditions often precede actual rate cuts. Indeed, market pricing has shifted significantly following a string of downside inflation surprises in H2 2023, and despite some ECB council members pushing against early pivots, this has already delivered looser financial conditions. This easing could reverse quickly, however.

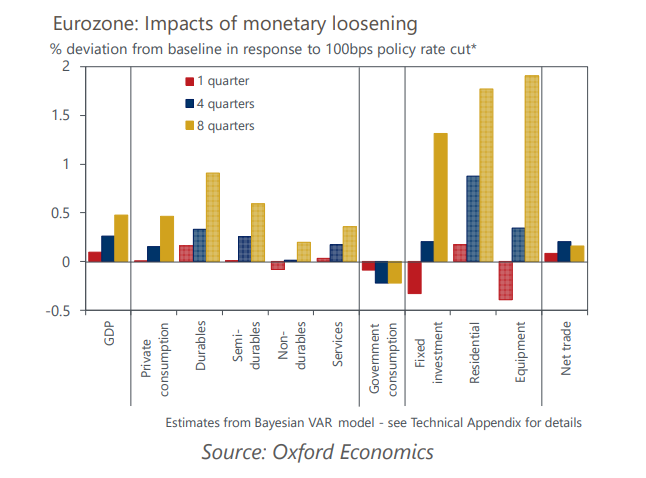

- We estimate the impact of policy rate cuts usually peaks around eight quarters later, but we see some scope for a faster pass-through in the current circumstances for both consumer and capital spending. This is due to healthier balance sheets, stronger position in the financial cycle and recent shortfalls in durables consumption and capex.

- Still, even a faster-than-usual pass-through of looser financial conditions and rate cuts won’t be a silver bullet for growth. Owing to the gradual recovery and weak base effects, we expect the eurozone GDP to only grow 0.6% this year. But we think growth will consolidate across GDP components this year, and alongside the boost from rate cuts this should generate strong growth of 1.8% in 2025.

Tags:

Related Posts

Post

Three reasons why UK inflation will swiftly return to target

The UK inflation outlook has been transformed by steep falls in oil and gas prices and the recent softening in core price pressures. We now expect CPI inflation to average 2.1% in 2024, down from our November forecast of 3.1%. Inflation is on track to return to the 2% target in April.

Find Out More

Post

Eurozone: How shipping disruption is affecting inflation and rate cuts

Disruption to shipping through the Red Sea now looks likely to keep transport costs elevated at least for the next few months. We estimate this will result in a peak lift of 0.3ppts to eurozone headline and 0.4ppts to core inflation in 2024, with the brunt of the impact coming in H2.

Find Out More

Post

Eurozone: Core goods disinflation should prompt rate cuts next spring

Weak demand, profit margin compression, easing pipeline pressures, and abating supply bottlenecks mean we see core goods inflation strongly coming down in 2024, supporting our below-consensus inflation forecast.

Find Out More