Acceleration in digitalisation will keep a service trade deficit in Japan

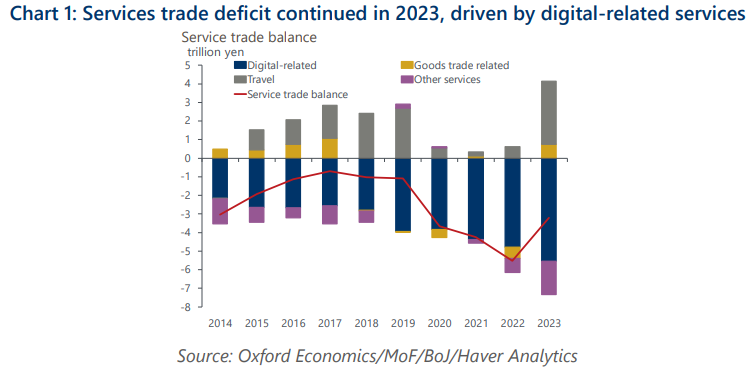

Japan’s services trade deficit continued in 2023, despite the sharp recovery to a travel surplus due to a rising number of inbound tourists after the pandemic. We project Japan’s services trade balance will remain in deficit over the coming years as a trend increase in the import of digital-related services will outweigh a rising travel services surplus that has been driven by inbound tourists.

What you will learn:

- In contrast to its success in manufacturing, Japan has been slow in moving up value chain in digital services. An aging population and the pandemic experience will accelerate the belated move toward digitalization, resulting in a demand drain through imports, especially from the US.

- The travel surplus will likely keep rising, driven by inbound tourists. However, it won’t be enough to offset the digital-related services deficit. The increase in the travel surplus will be constrained by a labour shortage in inbound tourism-related businesses and slow progress in raising consumption per head by providing higher value-added tourism services.

- Services trade deserves more attention in terms of its impact on Japan’s external balance and the FX market. Compared to goods trade, services trade has been more dynamic by responding more vividly to FX developments.

Tags:

Related Posts

Post

How Asia’s supply chains are changing | Techonomics Talks

Global supply chains have continued to expand, despite talk of deglobalization and nearshoring. US and Japan have started to de-couple from China, but other G7 countries grow more dependent on Chinese inputs. Several "hotspots" are emerging across Asia with multiple winning formulas.

Find Out More

Post

BoJ to raise its policy rate cautiously to 1% by 2028

We now project that the Bank of Japan will start to raise its policy rate next spring assuming another robust wage settlement at the Spring Negotiation. If inflation remains on a path towards 2%, the BoJ will likely raise rates cautiously to a terminal rate of around 1% in 2028.

Find Out More

Post

Japan inflation to rise to 1.8%, but downside risks are high

Reflecting a surprisingly strong Spring Negotiation result and weaker yen assumption, we have upgraded our baseline wage and inflation forecasts. We now project higher wage settlements will push inflation towards 1.8% by 2027. Uncertainty is high, however.

Find Out More