The euro and depreciation – shake, shake it off

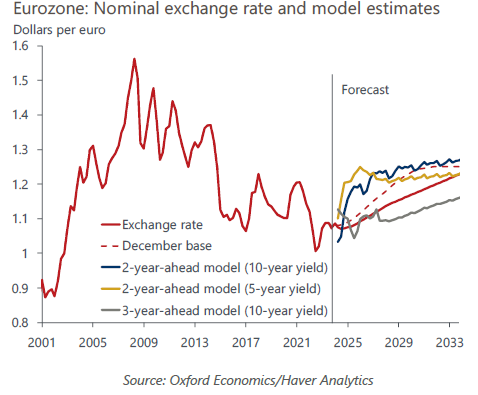

Our new forecast assumes a slower euro appreciation against the dollar over the coming years than we previously anticipated. Relative productivity, terms of trade, and the current account will likely be less supportive of the euro than we thought. In addition, a stronger stock market than initially envisaged will attract more financial flows into the US than we had expected.

What you will learn:

- We think that the euro will remain weak but, in broad terms, will not depreciate more this year. An energy prices-related negative terms of trade shock is unlikely, and news on US inflation should be less negative in the next few months.

- We expect the euro to start gaining value next year. A faster pace of Fed rate cuts than currently priced in by the markets would shrink the real yield differential in the euro’s favour. The higher relative return will make euro-denominated assets more attractive and support the currency.

- Further ahead, productivity should recover as temporary drags fade, supporting the euro. Workforce utilisation has been suboptimal due to labour hoarding by firms and the ongoing adaptation in the production structure. In addition, the strength of lower value-added services has exacerbated the weakness in productivity due to a compositional effect.

Tags:

Related Posts

Post

UK: Supply constraints are probably less prominent in the south

The extent to which UK employers can respond to likely 2024 interest rate cuts with increased output, rather than rises in prices and wages, will partly reflect the extent of spare capacity. This will inevitably vary by region. Evidence on this is imperfect, but in terms of capital assets (including intangibles) and labour availability, southern regions appear to be in a stronger position than those in the UK's traditional industrial heartland.

Find Out More

Post

GCC: Key themes shaping city economies in the near term

For Gulf cities, the near-term outlook will be tied not only to the global macroeconomic backdrop, but also the progress of the diverse visions and strategies in the region. With the aim to diversify their economies and reduce the dependence on oil, Gulf states continue to invest in the non-oil economy and implement various reforms. That said, oil revenues remain key to funding diversification efforts.

Find Out More

Post

Eurozone: ECB rate cut decisions won’t likely be affected by the Fed

A scenario where neither the Federal Reserve nor the European Central Bank cut rates in 2024 would reduce eurozone GDP by 0.5ppts by 2025. We still think the eurozone economy would grow by 0.5% in 2024, but the projected expansion in 2025 would be 1.4%, lower than 1.8% in our baseline forecast.

Find Out More