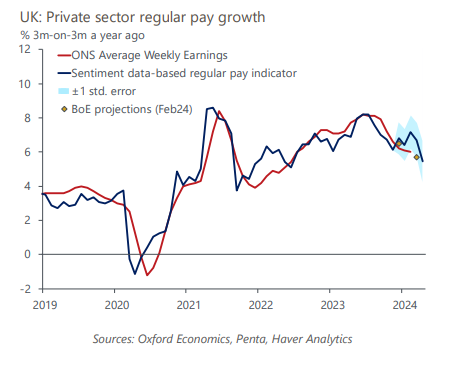

Nowcast shows wage growth slowing sharply

Our sentiment data, developed with Penta, suggests that UK private sector wage growth slowed sharply in March and early-April. If official data mirrors our sentiment indicator, it should keep the Monetary Policy Committee on track to cut interest rates in the summer.

What you will learn:

- Our nowcast also shows that labour demand continued to slow gently in the first months of 2024. In contrast to the significant volatility in recent Labour Force Survey data, our sentiment indicator points to a steady loosening in labour market conditions, more in keeping with the picture from recent data on job vacancies.

- Sentiment around talent and HR has dropped sharply in recent weeks, suggesting firms are finding it easier to recruit. Other labour demand scores are at, or below, historical averages.

- Sentiment around remuneration has also fallen, suggesting looser labour market conditions are mitigating the boost to pay growth from the large increase in the National Living Wage in April.

Tags:

Related Posts

Post

UK: Supply constraints are probably less prominent in the south

The extent to which UK employers can respond to likely 2024 interest rate cuts with increased output, rather than rises in prices and wages, will partly reflect the extent of spare capacity. This will inevitably vary by region. Evidence on this is imperfect, but in terms of capital assets (including intangibles) and labour availability, southern regions appear to be in a stronger position than those in the UK's traditional industrial heartland.

Find Out More

Post

Wheat prices soften in 2024, but risks tilted to the upside

Households have been grappling with sharply higher food bills over the past couple of years because of rocketing agricultural commodity prices, which have contributed to sharply higher inflation globally. Key amongst these agricultural commodities is the price of wheat, which is especially important in much of the developed world.

Find Out More

Post

UK : The everyday economy matters to local economic performance

The everyday economy generates half of all UK employment and 33% of GVA but is often dismissed because it generates less growth than high value services and has low productivity. But indirectly it has the capacity to improve the competitiveness and performance of local economies and has been identified by Labour Party leaders as a sector to focus on, if they win the election.

Find Out More