Trump presidency would be a headwind for US manufacturing

A second Trump presidency would directly harm US manufacturing through two channels: repeal of President Biden’s Inflation Reduction Act (IRA); and the enactment of new tariffs on goods. Those actions, combined with the overall macro impacts of the complete Trump agenda, will negatively impact manufacturing to the extent that the stated Trump campaign promises, as modelled in our two Trump presidency macro scenarios, are implemented in full. However, the effects of both direct channels would likely be relatively modest.

What you will learn:

- The subsidies and other provisions contained in the CHIPS Act and IRA helped spur a boom in factory construction in sectors that are targeted by the legislation. Repeal of the IRA, which still has years of tax credit eligibility written into law available for firms, would likely halt or severely slow this kind of new investment, but the small scale of these manufacturing sub-sectors means the impact on total industrial output would be limited.

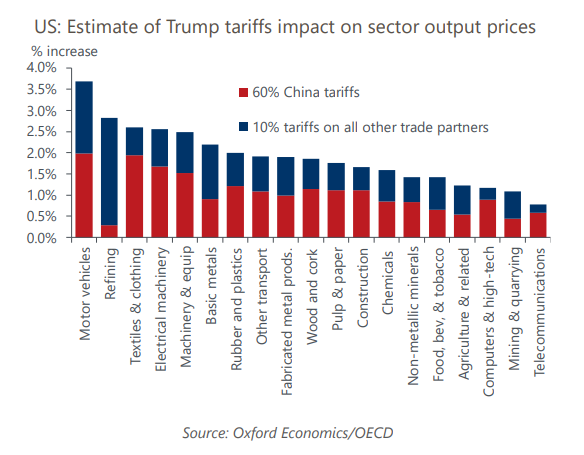

- Trump’s campaign promise to enact 60% tariffs on all goods coming in from China and 10% on the rest of the world would, if enacted, raise input costs for most industrial sectors. However, US industry’s direct consumption of Chinese intermediate goods is relatively low, and it is even smaller in services. As such, modelled output price impacts suggest potential price increases of up to 3.7% in the most affected sector. While the stated goal of Trump’s China tariffs is to reduce dependence on Chinese manufacturing and re-shore production to the US, we see them as unlikely to spur a meaningful shift towards domestic manufacturing as firms would likely source parts from other countries, either via new suppliers or by trade diversion.

- The biggest hit to US manufacturing from a renewed Trump presidency that fully enacts stated campaign promises would likely be through weaker demand. Higher inflation and interest rates would weigh on consumption and investment and retaliatory tariffs would weigh on manufacturing exports. We think this would lead to a small contraction in industrial production peaking in 2027. However, we see such a potential demand hit as temporary.

Tags:

Related Services

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More