Keeping the hawks at bay

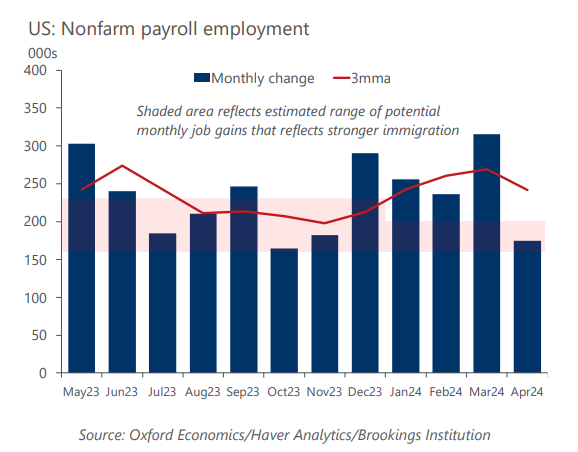

The lower-than-expected increase in nonfarm payroll employment, along with declining job openings and quits, suggest that wage pressures are unlikely to re-intensify and push up service prices, which account for most of the Federal Reserve’s preferred inflation gauge. The totality of the week’s labor market data reinforces our baseline assumption that the Fed will begin cutting interest rates in September, and markets have moved toward our view following the April jobs report. The central bank still needs a string of benign inflation prints, which we think will occur as price gains associated with housing and non-energy, nonhousing services moderate.

What you will learn:

- The April jobs report keeps the hawks at bay, as it showed job growth slowing to a sustainable pace that will not put upward pressure on inflation and average hourly earnings rising less than expected. Earlier in the week, the employment cost index, our preferred measure of wage growth, advanced more than expected, but we attribute some of the upside surprise to residual seasonality. More importantly, a falling quits rate points to a resumption of moderating wage growth in the coming quarters.

- Initial claims for unemployment insurance are low, and this is unsurprising, given that jobless workers are finding employment more easily than they did, on average, during the past two expansions. However, initial claims are exaggerating the tightness of the labor market to the extent that other influences, such as stricter eligibility requirements and reduced benefit generosity, are weighing on this much-watched leading indicator of economic activity.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More