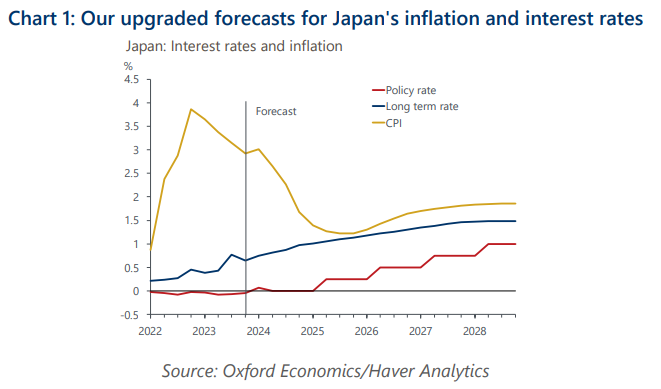

BoJ to raise its policy rate cautiously to 1% by 2028

We now project that the Bank of Japan will start to raise its policy rate next spring assuming another robust wage settlement at the Spring Negotiation. If inflation remains on a path towards 2%, the BoJ will likely raise rates cautiously to a terminal rate of around 1% in 2028.

What you will learn:

- In our view the BoJ’s policy reaction function has changed. If the BoJ continues to give absolute priority to meet the 2% inflation target, it will take a shallower path. However, the bank’s recent moves and messages reveal a strong appetite to return to positive interest rates earlier as long as inflation is broadly heading towards target.

- It’s possible that the next rate hike will happen in H2 2024, depending on the pass-through of wage rises to service prices. Still, the room for the amount of hikes is limited due to the huge downside risks in the price outlook, especially the sustainability of wage rises and pricing power. And even if a labour shortage continues to push up wages and inflation, the BoJ may hesitate to raise the policy rate if household income and consumption remain stagnant.

- Higher short-term policy rates and rising term premium caused by more uncertainty and volatility around inflation and monetary policy means we have raised our estimate for the long-term equilibrium rate for 10-year JGB yields to 1.5% from 0.7%.

- We think the BoJ will devise an exit strategy from QE policy later this year after the policy review that is underway. The BoJ will allow long-term yields to rise gradually driven by fundamentals, but those steps likely will be cautious to avoid a disorderly rise.

Tags:

Related Posts

Post

BoJ likely to end zero interest rates in autumn

As expected, the BoJ maintained its policy rate at 0%-0.1% at Friday's meeting. With more confidence on the ongoing wage-driven inflation dynamics and a strong appetite for policy normalisation, the BoJ looks more likely to end its zero-interest rate policy in the autumn.

Find Out More

Post

How Asia’s supply chains are changing | Techonomics Talks

Global supply chains have continued to expand, despite talk of deglobalization and nearshoring. US and Japan have started to de-couple from China, but other G7 countries grow more dependent on Chinese inputs. Several "hotspots" are emerging across Asia with multiple winning formulas.

Find Out More

Post

Japan inflation to rise to 1.8%, but downside risks are high

Reflecting a surprisingly strong Spring Negotiation result and weaker yen assumption, we have upgraded our baseline wage and inflation forecasts. We now project higher wage settlements will push inflation towards 1.8% by 2027. Uncertainty is high, however.

Find Out More