US job growth to downshift in March

We expect the March employment report to show moderating job growth, adding to the Federal Reserve’s confidence that the labor market is rebalancing and that wage growth has slowed. However, given recent inflation data, the jobs data will not be enough to keep the Fed on track for a May rate cut; we will push the timing of the first cut back in the April baseline forecast.

What you will learn:

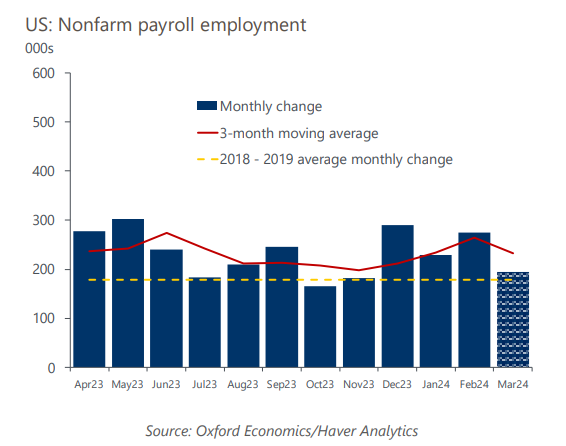

- We estimate that nonfarm payrolls increased by a net 195,000 in March, a deceleration from 275,000 in February. Private employment will drive the job growth slowdown in March, and we expect it to be fairly broad-based.

- Average hourly earnings growth was noisy in January and February because of weather-related impacts and minimum wage increases. We expect y/y earnings growth to slow to 4.1% in March from 4.3% in February. Most measures of wage growth are still too strong for the Fed, but forward-looking measures like the quits rate should reassure the central bank that wage growth is on a path to a pace consistent with its 2% inflation target.

- We forecast a 0.1ppt decline in the unemployment rate in March to 3.8%. A rise in unemployment among younger workers was the cause of a rise in the unemployment rate in February, and we expect that to at least be partially reversed in March.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More