Eurozone: ECB rate cut decisions won’t likely be affected by the Fed

A scenario where neither the Federal Reserve nor the European Central Bank cut rates in 2024 would reduce eurozone GDP by 0.5ppts by 2025. We still think the eurozone economy would grow by 0.5% in 2024, but the projected expansion in 2025 would be 1.4%, lower than 1.8% in our baseline forecast.

What you will learn:

- Although this possibility is being discussed, we think the likelihood of this scenario is low. The Fed is sending a clear message that it anticipates lowering rates this year, with the median projection of its dot plot showing a cumulative 75bps of rate cuts in 2024. Even if the Fed doesn’t loosen monetary policy this year, our analysis shows the impact on the ECB rate decisions would be minimal. We don’t think it will affect the timing of the first cut, though there is a risk it could prompt the ECB to cut rates by less than we currently expect this year.

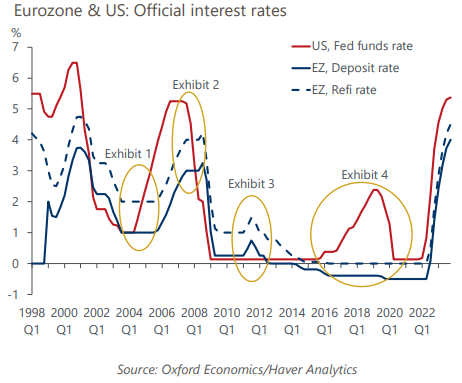

- It is often stated that the ECB would not and has not diverged from the Fed, but this is simply not true. The large differences in economic performance in the eurozone and the US suggest this could become another episode of divergence. We also show that the key channels through which the Fed affects the eurozone haven’t had a statistically significant impact on ECB rate decisions. There’s little reason to think the ECB will be more dependent on the Fed this time. Finally, the Governing Council has signalled that a rate cut in June is likely, regardless of what the Fed does.

- Rather than looking at the Fed, the likely path ahead for the ECB will be determined by developments in the eurozone economy, with wage and services inflation the key variables.

Tags:

Related Posts

Post

New ECB framework a versatile toolkit for uncertain times

The European Central Bank's updated monetary policy framework retains key advantages of the previous system and in our view is well-tailored to the eurozone's bank-dominated financial infrastructure. It also gives the ECB a versatile toolkit allowing it to react flexibly to episodes of market stress.

Find Out More

Post

Why we believe the industry cycle in the Eurozone is finally turning

Even though incoming hard data on eurozone industry is still downbeat, leading indicators suggest that we're at a turning point. We expect favourable cyclical and structural tailwinds will now take over, and industry output to accelerate through this year to 2% y/y growth by Q4.

Find Out More

Post

Eurozone: Stubborn services inflation should not delay rate cuts

A slower fall in services inflation will partially offset the relatively stronger disinflationary forces in goods prices. We do not think it will derail European Central Bank rate cuts this year, but the pass-through of strong wage growth from the tight labour market poses upside risks

Find Out More