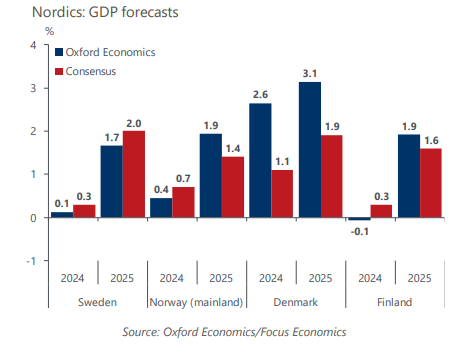

Nordics: Growth to pick up this year, but it will diverge

The Nordic economies will have a better 2024 than last year, but growth rates will diverge across the region. The main growth drivers will be improving domestic demand, higher confidence, and easing financial conditions amid lower inflation and policy easing. A pharma boom will make Denmark outperform, while a weak finish to 2023 will weigh on growth in Finland and Sweden.

What you will learn:

- Confidence has improved across all sectors, indicating that the worst is over. Lower inflation, still tight labour markets, and positive real income growth should translate to higher private consumption. Interest rate-sensitive fixed investment will resume growth as rates decline.

- Headline inflation will continue to decline faster than core inflation, which is more affected by strong wage growth. We expect that energy and food prices, which have been the main drivers of the initial inflation surge, will continue to be the main drivers of the disinflation. Disruptions to Red Sea shipping should not derail disinflation, but they present an upside risk.

- Attention has turned towards the timing of rate cuts as growth slows and underlying price pressures abate. We expect Sweden’s Riksbank to commence with rate cuts in May or June, but Norway’s Norges Bank will stay on hold until December. Currency developments in both countries will remain important factors in central bank policymaking this year.

- Easing financial conditions will pass through to the economy relatively quickly, due to the prevalence of variable rate loans. This will be a key driver for improving demand; its weakness has become the main factor limiting output.

Tags:

Related Posts

Post

Nordics: Climate policies will have an uneven impact across regions

The growing impact of climate change means that mitigation policy is becoming more prominent across the Nordic region. The transition policies that governments enact will have significant economic consequences, and their impact will be felt unevenly across regions. To help organisations understand the implications of different policies, we have developed a range of scenarios which plot potential pathways towards net zero.

Find Out More

Post

GDP growth for Denmark downgraded as winter recession looms large

We now expect Denmark to enter a shallow recession in Q3 this year, ending in Q1 2023, due to rising energy costs, exhausted reopening tailwinds, and tightening financial conditions. We have cut our GDP growth forecasts by 1.2ppts to 2.3% in 2022 and by 0.7ppts to 0.5% in 2023. Beyond 2023, it will take several years for GDP to return to our previous baseline. Government subsidies for energy bills will provide some relief for the poorest consumers, while the relative insulation of the Nordic electricity market is preventing even sharper rises in electricity prices.

Find Out More

Post

War in Ukraine presents new headwinds for the Nordics

While the economic fallout from Russia's invasion of Ukraine will likely be limited for the Nordic region, we have nonetheless trimmed our 2022 growth forecasts. Inflation will peak higher, dragging on consumption and prompting faster monetary policy tightening in Sweden. Nordic energy dependence on fossil fuels from Russia is among the lowest in Europe, and apart from Finland, trade with and industry inputs from Russia and Ukraine are negligible.

Find Out More