House price indexes rose steadily in most US metros

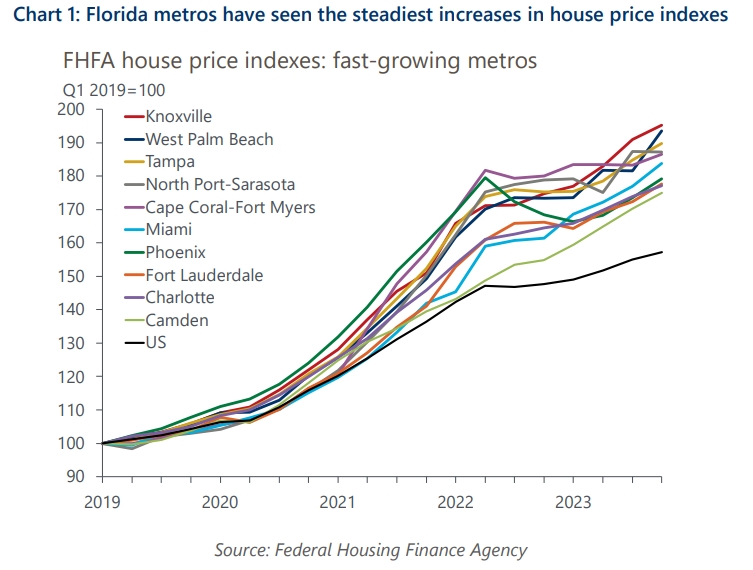

House prices increased in all but a handful of metros in Q4 2023 as indicated by their Federal Housing Finance Agency (FHFA) purchase-only house price indexes. However, the quarterly growth rates of the indexes decelerated in Q4 compared to Q3 in nearly three-quarters of the metros.

What you will learn:

- Metros that saw the largest quarterly increases in their index were West Palm Beach, San Diego, Tucson, Indianapolis, and Miami. All of these also showed some of the highest y/y increases.

- Metros with the steepest quarterly declines were Honolulu, San Francisco, Baton Rouge, Winston-Salem, and Seattle. These metros also saw weak y/y growth, or in some cases, y/y declines.

- The Midwest and Northeast metros continued to see the steadiest house price index gains in Q4 with only a few incurring slight declines. The New York metro division saw robust gains in Q4. Florida metros continued to be among the fastest growing, yet a few southern metros continued to trail.

Tags:

Related Posts

Post

Demographics are set to propel niche property types in the UK

As the UK population ages, time-use data suggest that the property sectors with structural tailwinds will be those that provide space for activities related to home entertainment, eating and drinking, socialising, events, leisure, hobbies, and sports/exercise.

Find Out More

Post

Indian and Australian cities to outpace rivals over 2024-28

We forecast Indian cities to outpace the rest of APAC in terms of GDP growth over the medium term (2024-28). Southeast Asian cities such as Ho Chi Minh City and Jakarta will come close to matching Indian cities and will outperform Chinese ones. Among advanced APAC cities, we expect that Australian ones will fill the top two positions in terms of medium-run GDP growth.

Find Out More

Post

Europe: medium-term cities outlook improves after a tough few years

The short-term outlook for Europe's largest cities remains subdued, but as the current pressures ease the medium-term picture is set to improve. We expect GDP growth to pick up pace from 2025 onwards and settle at 2.1% on average through to 2028. This will still be weaker than in the years preceding the pandemic.

Find Out More