The big questions for China macro policy this year

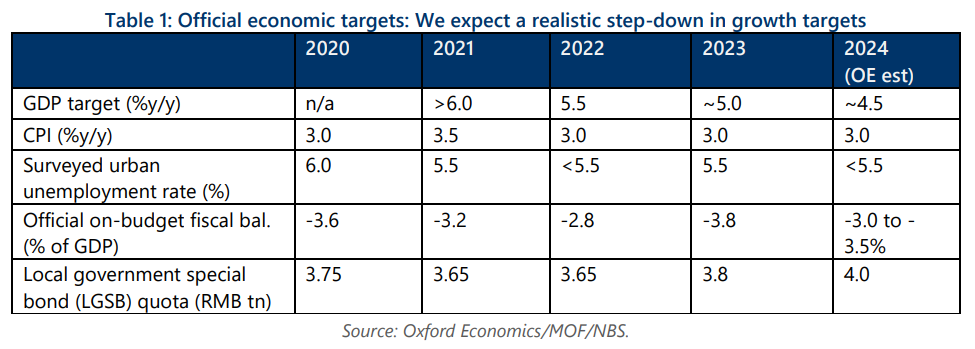

Ahead of this spring’s Two Sessions, we expect officials to realistically stake their growth target at around 4.5% in 2024 – a more sustainable, though likely still above-potential, pace than in 2023. Risks to our baseline forecast are titled to the upside, as fiscal easing could prove more forthcoming, and the poor performance of exports could improve. This report analyses some of the key questions regarding China macro policies in 2024.

What you will learn:

- Fiscal stimulus in 2024 will include greater support for policy banks, tax waivers, and other cost-offsets for businesses, plus spending on both old and new infrastructure. Quasi-fiscal tools, such as the pledged supplementary lending (PSL) facility, will also play a bigger role.

- Broad-based, direct support for household consumption still seems unlikely, even as China grapples with a confidence crisis. We expect private consumption to slow to a respectable 5.2% in 2024, from an estimated 8.7% in 2023.

- Property easing will likely continue in the form of further liquidity injections into policy banks for housing projects, more direct subsidies to improve housing affordability and induce consumers to purchase homes, and a restructuring of property developer balance sheets to liquidate high inventory and bad loans with the assistance of state banks.

- Although accommodative monetary policies are necessary, the room for a further meaningful decline in rates is limited.

- We expect a mild appreciation of the renminbi deeper into H2, ending 2024 at 7.0 to the dollar on narrowing US-China rate differentials, stabilizing domestic fundamentals, a smaller current account surplus, and continued spot intervention from the PBOC to stem depreciation pressures.

Tags:

Related Posts

Post

Global Scenarios Service: Inflation Victory?

The outlook for the global economy has improved since the previous quarter’s Global Scenarios Service report and a soft landing is in prospect. While we anticipate a period of only steady and unspectacular growth ahead, this is no mean feat after the aggressive policy rate hikes of 2022 and 2023.

Find Out More

Post

Chinese office markets look set for a lost decade

Office markets across China's major cities continue to deteriorate after consecutive years of rising vacancy rates and falling rents. Vacancy rates are now 20%-40% across the major cities – the highest among all major global markets.

Find Out More

Post

The latest export from China is … deflation

We expect Chinese export price deflation to provide a helpful tailwind in the struggle to bring EM inflation back to target.

Find Out More