Short-term headwinds to slow GDP growth across major cities

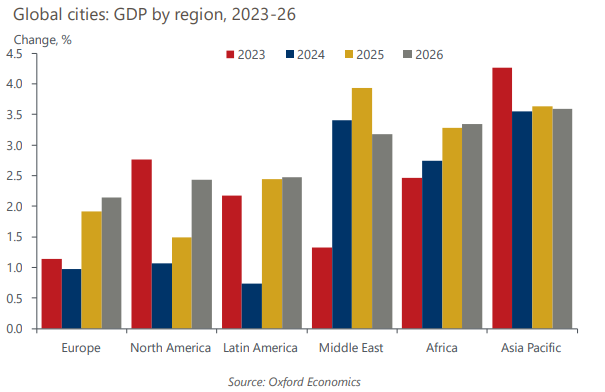

Following a year of subdued global growth in 2023, we think a further softening of economic conditions is likely next year, before activity gathers pace in 2025-26. In this context, we forecast the world’s 1,000 major cities combined will achieve GDP growth of just 2.4% per year over 2024- 26, marking not only a sizeable slowdown from the expected outturn in 2023, but also compared to the 5-year trend of 3.0% per year achieved prior to the pandemic.

What you will learn:

- In 2024, economic growth in many European cities will be hampered by the lagged impact of tighter monetary policies, the recent cost of living squeeze, uncertainty around house prices, and consequent slowdowns in consumer spending. There will, however, be some cities that weather the storm better than others.

- Most North American cities will see GDP growth slow in 2024, with many battling to avoid contractions. Weak activity in interest rate sensitive sectors including finance, insurance, and real estate will be a prominent feature. Latin American cities will also see GDP growth slow sharply in 2024 before rebounding in 2025-26.

- Whilst 2024 will be a challenging year for advanced city economies, many in emerging market cities should see a more positive GDP growth outturn in 2024 than 2023, with those in Africa and the Middle East performing particularly well.

- The short-term outlook for the world’s 20 largest cities is sluggish, especially when compared to pre-pandemic growth. That said, these 20 cities alone will contribute one fifth of the expected GDP increase across the 1,000 cities covered in this analysis.

Tags:

Related Posts

Post

Indian and Australian cities to outpace rivals over 2024-28

We forecast Indian cities to outpace the rest of APAC in terms of GDP growth over the medium term (2024-28). Southeast Asian cities such as Ho Chi Minh City and Jakarta will come close to matching Indian cities and will outperform Chinese ones. Among advanced APAC cities, we expect that Australian ones will fill the top two positions in terms of medium-run GDP growth.

Find Out More

Post

Major China cities face prospect of growth downshift

Over the next five years China and its major cities face the prospect of a significant downshift in economic growth. We forecast GDP to grow on average by 4.1% per year across 15 major cities in the years to 2028, down from 7.3% between 2015-2019.

Find Out More

Post

Europe: Among major southern cities, Madrid looks strongest

We are cautiously optimistic about the medium-term outlook for Europe's cities as a whole, but less sanguine about southern European cities than most others. They have tended to underperform in the past and will probably do so in the future. Madrid, the largest, has the strongest growth prospects of the larger cities.

Find Out More