CRE key themes 2024 – A year of transition

After a difficult 2023, we think five key themes will shape the outlook for commercial real estate next year:

- Global growth will be sluggish, but rate cuts offer an upside for CRE.

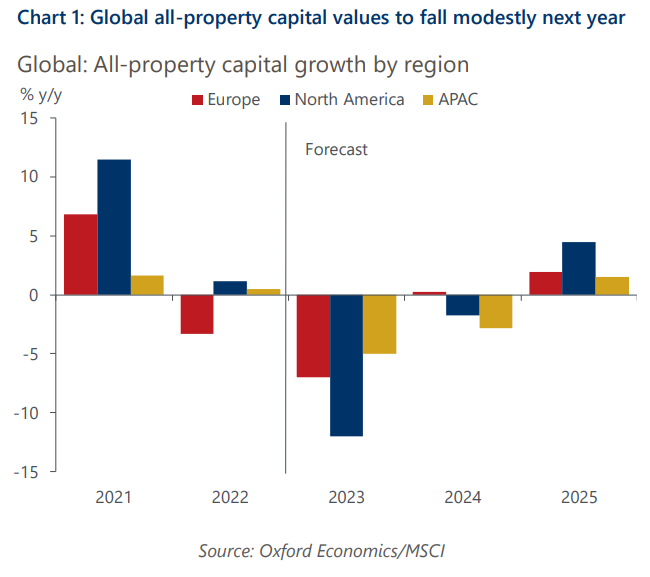

- 2024 will be a year of transition for CRE values.

- Opportunities will start to emerge but mostly in the industrial sector.

- REITs will outperform the private market again.

- New supply across all sectors and regions will be slow.

Fill in our form to download the report. To download the infographic, please click here.

Tags:

Related Posts

Post

Relative return index signals improving CRE attractiveness

Our latest global relative return index (RRI) signals that risk-adjusted investment opportunities in commercial real estate (CRE) should start to emerge this year before becoming more widespread in 2025. At this point, our baseline expected returns move higher than required returns, pushing the global all-property index above the 50 mark.

Find Out More

Post

Global Private equity real estate fund maturities spur asset sales

We expect the significant increases in fund maturities, spurred by capital raised over the past decade, to exert upward pressure on the rate of asset disposals as the funds approach the end of their lifecycles.

Find Out More

Post

Infographic: Key macroeconomic risks impacting global real estate performance

Continued economic growth will help stabilise commercial real estate yields and values before pricing slowly begins to recover next year. We expect global all-property total returns to average 5.3% per year over 2024-2025 in our baseline scenario. However, there are still upside and downside risks that real estate professionals should watch out for. In this infographic, we outline these risks and their impacts on property value.

Find Out More