A weaker dollar hinges on better global growth prospects

The dollar will continue to be supported by a high carry and the relative resilience of the US economy. Even the recent loosening of financial conditions – itself based on the pullback in yields and a more flexible Fed – have only partially dented the USD bullish trend.

What you will learn:

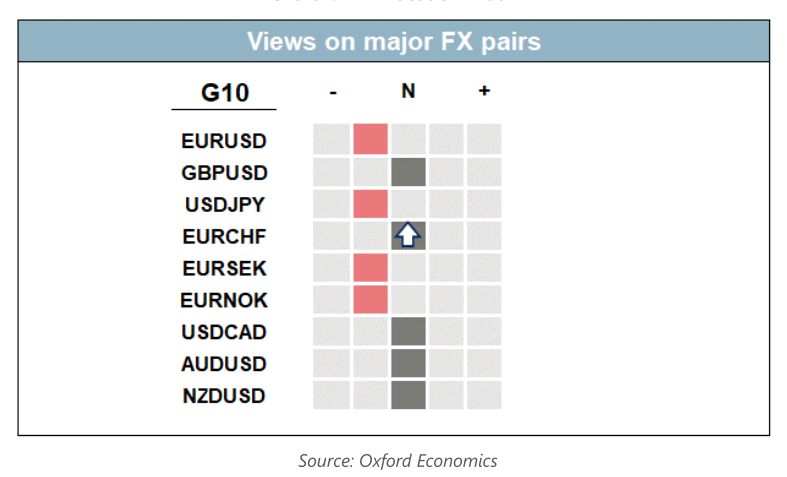

- We do not expect major policy shifts heading into year end and given the broad similarity of G10 rate cutting cycles that are priced in, we expect range trading behaviour across major US dollar crosses in the near term.

- The greenback is overvalued fundamentally, but 2024 will disappoint dollar bears. The pivot the market expects on the back of weaker data and continued benign disinflation – in part driven by lower commodity prices – will take time to materialise.

- Our first rate cut is after the summer of 2024, leaving the US with still elevated short-term real rates. Worsening global liquidity will also be USD-positive in 2024, except against the yen. The latter is poised to outperform major cyclical G10 (GBP, AUD and CAD) crosses in 2024.

Tags:

Related Posts

Post

Trumponomics – the economics of a second Trump presidency | Beyond the Headlines

The 2024 US Presidential Election is less than seven months away. In this week’s Beyond the Headlines, Bernard Yaros, Lead Economist, outlines two scenarios for the US economy if former President Donald Trump returns to the White House and Republicans sweep Congress.

Find Out More

Post

Cross Asset: Closing our tactical long on gold, but we’re still bullish

The strength of the recent gold price rally has defied even our already bullish expectations and we think prices are vulnerable to a price consolidation in the short term. As a result, we close out our tactical long position on gold that we opened in October last year.

Find Out More

Post

How Inflation eroded governments’ debts and why it matters | Beyond the Headlines

The supply-shocks era (2020-23) represented the first time in a generation where inflation significantly eroded the real value of global public debt. In this week’s video, Gabriel Sterne, Head of Global Emerging Markets, focuses on the extent to which governments seized that opportunity.

Find Out More