Economies with pre-existing conditions suffer bigger Covid scars

We project the distribution of long-term economic pain inflicted by Covid will be similar to humans in the sense that those with pre-existing conditions will end up suffering the most.

What you will learn:

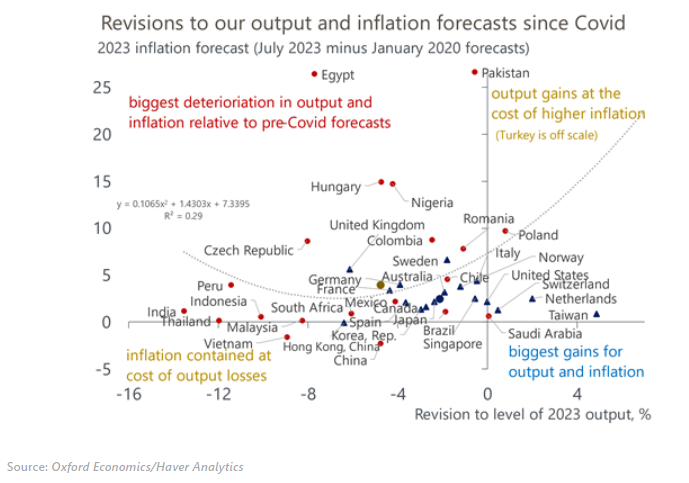

- The current level of GDP is an intermediate measure of scarring from Covid and the global supply shocks induced by the Russia/Ukraine war. Scarring appears more severe in emerging markets (EMs) than advanced economies (AEs).

- Egypt, Hungary, Nigeria, Czech Republic, and the UK appear to have endured the worst scarring trade-off in terms of impact on the level of 2023 output and inflation. In 2023, GDP scarring is most evident in EM Asia, but these economies also have the least inflation scarring.

- Our baseline projects EMs’ scarring gaps will eventually rise further. By 2028, we project the GDP level to reach 6% below pre-Covid GDP projections for EMs versus 0.6% for AEs.

- By then, the most significant determinants of cross-economy variation in GDP scarring will be labour market inflexibility and the interaction of the indirect impact of much tighter global monetary conditions with preexisting financial vulnerabilities.

Tags:

Related Posts

Post

Acceleration in digitalisation will keep a service trade deficit in Japan

We project Japan's services trade balance will remain in deficit over the coming years as a trend increase in the import of digital-related services will outweigh a rising travel services surplus that has been driven by inbound tourists.

Find Out More

Post

Chinese Outbound Travel to Gain Momentum in 2024

Chinese outbound travel finally restarted in 2023. This re-opening was keenly anticipated by global destinations, given the significance of China as an outbound market. Chinese outbound travel will stride further towards recovery in 2024.

Find Out More