Exploring the plausible ‘What Ifs’ to our 2023 China GDP forecast

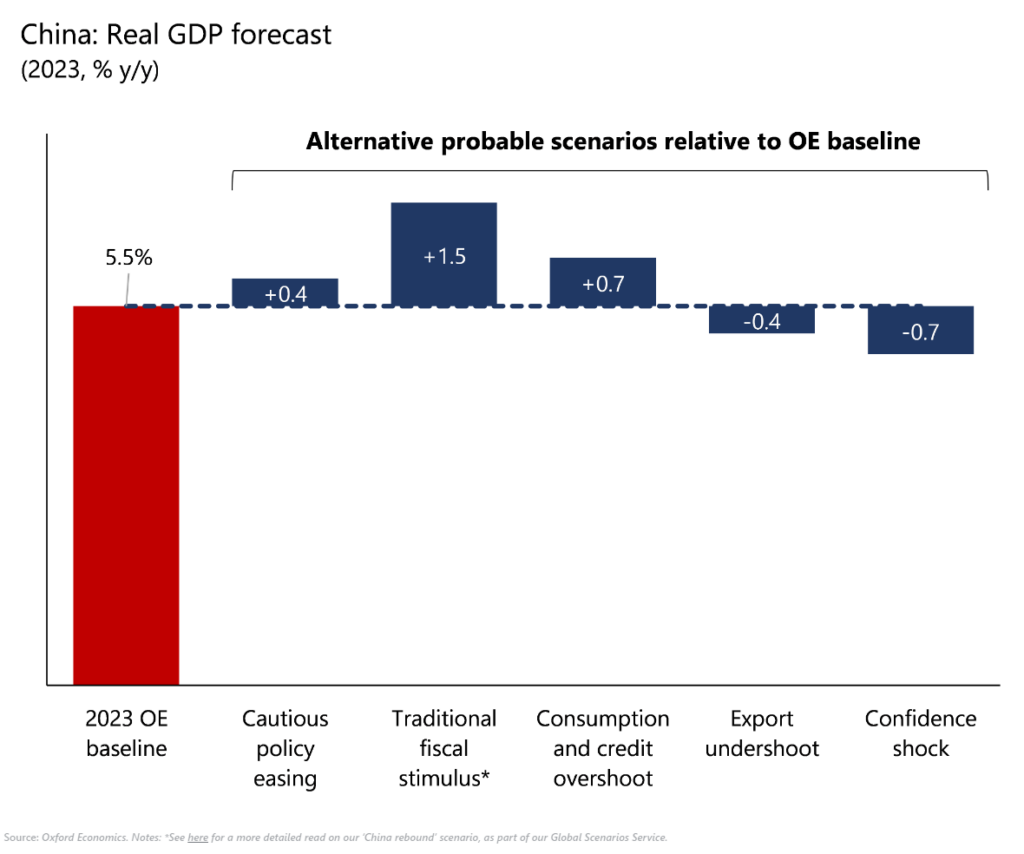

On the back of China’s recent consumption outperformance, we now expect the economy to grow by at least 5.5% in 2023. Market forecasts vary considerably, reflecting differences in assumptions around policy risk, the health of and outlook for the property sector, and the size and longevity of the reopening consumption boost.

What you will learn:

- As a thought experiment, we analysed five probable alternative scenarios using our Global Economic Model to gauge both the upside and downside risks to our 2023 outlook for China, and find a variance of around -0.7ppts to 1.5ppt to our 5.5% baseline growth forecast.

- Our analyses also demonstrate the clear limitations of policy easing, which in our downside scenarios prove insufficient to fully offset growth headwinds.

- In our base case and notwithstanding the eventual fading of a post-Covid consumption boost, growth in 2023 should comfortably exceed the official growth target. The unusual combination of a strong organic growth and still-significant economic headwinds (particularly towards H2) means that China’s monetary and fiscal policy stance could stay on hold for longer.

Tags:

Related posts

Post

MINGTIANDI: Oversupply weighs heaviest on China’s office markets

China’s office markets have been flooded with new supply, evidenced by higher vacancies relative to other global markets.

Find Out More

Post

Beijing’s new industrialisation gamble – will it pay off?

Beijing's reinvigorated support for manufacturing is quite the economic gamble. With property still in the doldrums and the post-Covid services recovery having largely run its course, the rationale is that manufacturing could minimise the risk of a broader activity slowdown.

Find Out More

Post

Global Scenarios Service: Inflation Victory?

The outlook for the global economy has improved since the previous quarter’s Global Scenarios Service report and a soft landing is in prospect. While we anticipate a period of only steady and unspectacular growth ahead, this is no mean feat after the aggressive policy rate hikes of 2022 and 2023.

Find Out More