Research Briefing

| Oct 21, 2022

The risk of distress has risen, but REITs look well positioned

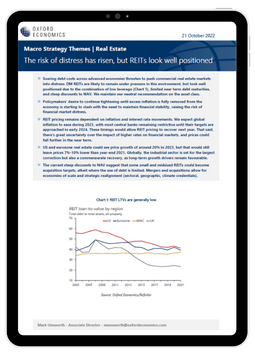

Soaring debt costs across advanced economies threaten to push commercial real estate markets into distress. DM REITs are likely to remain under pressure in this environment, but look well positioned due to the combination of low leverage, limited near term debt maturities, and steep discounts to NAV. We maintain our neutral recommendation on the asset class.

What you will learn:

- Policymakers’ desire to continue tightening until excess inflation is fully removed from the economy is starting to clash with the need to maintain financial stability, raising the risk of financial market distress.

- REIT pricing remains dependent on inflation and interest rate movements. We expect global inflation to ease during 2023, with most central banks remaining restrictive until their targets are approached in early 2024. These timings would allow REIT pricing to recover next year. That said, there’s great uncertainty over the impact of higher rates on financial markets, and prices could fall further in the near term.

- US and eurozone real estate could see price growth of around 20% in 2023, but that would still leave prices 7%-10% lower than year-end 2021. Globally, the industrial sector is set for the largest correction but also a commensurate recovery, as long-term growth drivers remain favourable.

Tags:

Related Services

Service

Real Estate Forecasts and Scenarios

Understand the prospects and risks to your real estate investments by location and property type.

Find Out More

Service

Construction and Infrastructure Advice

Decades of experience combined with premier analytical frameworks enable us to provide you with the right advice at the right time.

Find Out More