Which regions are most exposed to the 25% automotive tariffs?

The US is set to impose new tariffs beginning April 2, adding an additional 25% on all imports of passenger vehicles, light trucks and certain automotive parts. While there is sufficient spare capacity to accommodate some near-term reshoring to existing US facilities, this would come at the expense of reduced competition, higher prices, and significantly lower production in the US’s main trading partners.

What you will learn:

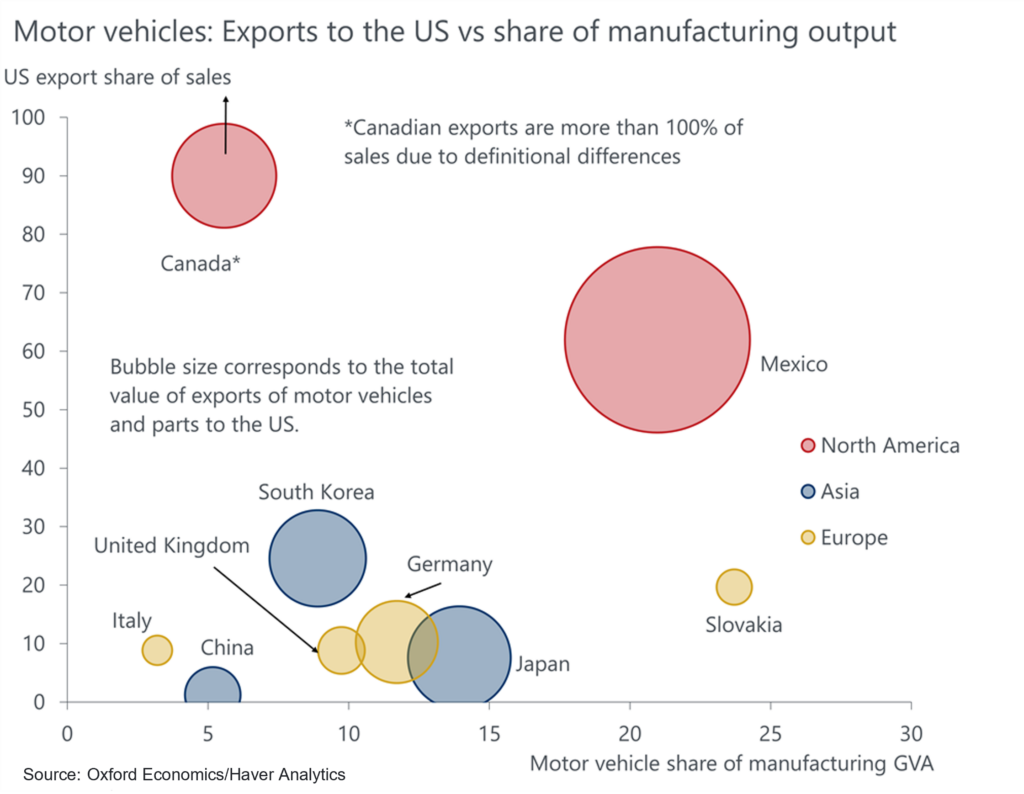

- Tariff disruption will be felt most across the Mexican border states, while Ontario bears the brunt in Canada. Both Canada and Mexico export a large share of total automotive sales to the US, and automotive parts also cross borders several times before final assembly.

- Outside of North America, Japan and South Korea are the largest automotive exporters to the US. Anecdotally, Japanese car companies are preparing to ramp up production at their existing US plants, suggesting that even the threat of tariffs will likely curtail production in Japan.

- While the direct export exposure to the US is smaller in Europe than elsewhere, motor vehicles are an important manufacturing sector in several countries, especially in CEE economies such as Slovakia and the Czech Republic.

- While the tariffs will likely have the effect of reshoring some automotive production to US plants, it will also raise the cost to US manufacturers and households. Our analysis suggests that the tariff applies to nearly one third of the price of the car.

Tags:

Related Reports

Tariffs take a toll despite easing trade hostilities

Global tradeflows remain under pressure despite easing tariff tensions. Recent US–China agreements reduce select import taxes and support China’s 2026 outlook, yet US imports continue to fall and supply chains pivot toward Asia and Europe. Containerised trade is set to expand, while bulk shipments soften alongside weaker industrial demand.

Find Out More

Global trade is losing momentum

Trade disruptions spread across autos and pharma sectors, with EU tariff exemptions giving Europe a competitive edge amid global slowdown.

Find Out More

Why have China’s exports held up so well under higher US tariffs?

China's exports have adapted, rather than retreated, under higher US tariffs. It will be difficult for businesses and consumers to decouple from Chinese exports or China-linked supply chains.

Find Out More

ASEAN growth opportunities following US-China Tariffs

Using sectoral production data from Oxford’s Global Industry Service, we have been able to quantify which countries and sectors have the greatest potential for production migration. Applying this framework across Asia reveals meaningful industrial depth in Vietnam, Thailand, and Malaysia in trade-intensive segments, and a distinctive, more resource-heavy footing in Indonesia and India.

Find Out More