Stopgap Spring Statement leaves problems unresolved

The Spring Statement delivered on Wednesday 26 March is likely to prove a stopgap ahead of a more comprehensive overhaul of UK fiscal policy in this autumn’s Budget.

What you will learn:

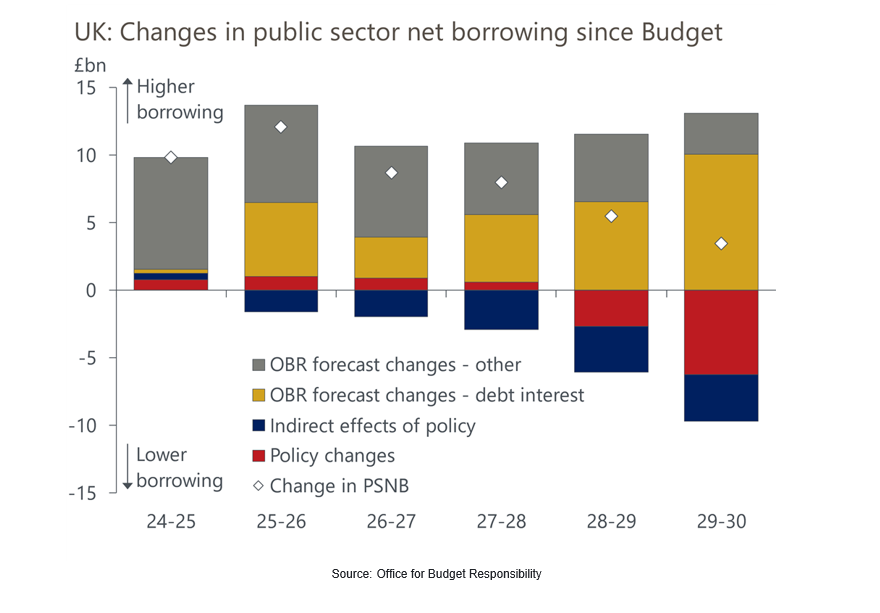

- The Chancellor blamed global instability for the deterioration in the Office for Budget Responsibility’s economic and fiscal forecasts. But the need to take remedial action was a consequence of leaving so little headroom in October’s Budget, and the new plans leave a similarly slim margin for error in 2029-2030.

- We already thought the OBR’s potential output forecasts were too optimistic, and today it upgraded them further after incorporating the impact of the government’s planning reforms. After years of productivity growth disappointing, we think the risks are heavily skewed towards a worse outcome.

- The new plans assume the government will increase defence spending to 2.5% of GDP. But the NATO target will likely rise to 3% or more, forcing the government to choose between further tax rises, greater spending restraint, or changing its fiscal rules yet again.

Tags:

Related Reports

Flooding risks diverge across UK cities, sectors and economies

Climate-linked flooding is becoming more severe, reshaping risks for UK cities, real estate, and local economies. Which areas face the greatest impact—and why?

Find Out More

Better affordability puts UK housing market on firmer footing

UK housing affordability has strengthened since 2022, supporting rising prices—but with pay growth slowing and limited rate cuts ahead, is the market nearing a plateau?

Find Out More

London’s productivity slump highlights Manchester’s momentum

The UK’s productivity performance has been lacklustre since the 2008 global financial crisis—both historically and relative to its international peers.

Find Out More

Shell’s Socioeconomic Impact in the United Kingdom, 2022

This report assesses the socioeconomic contributions Shell made in the United Kingdom in 2022. It quantifies Shell’s impact on the UK economy and society, including its £11.8 billion contribution to GDP, support for 78,000 jobs, £5.4 billion in tax payments, and investments in skills, training, and community programmes across the country.

Find Out More