Why official UK data are less reliable and what this means

A series of problems have undermined confidence in the accuracy of official economic statistics for the UK. When using Office for National Statistics data, it’s important that users make allowance for the increased uncertainty about their reliability.

What you will learn:

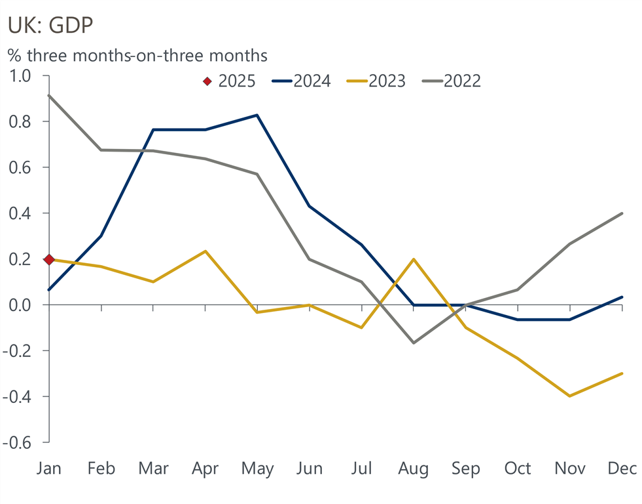

- As well as the well-publicised problems with the ONS Labour Force Survey and population estimates, trade and producer prices releases have had to be postponed recently. Other problems are emerging that are yet to be officially acknowledged, including volatility in GDP and retail sales data that are indicative of problems related to seasonal adjustments.

- Big structural changes, such as rapid adoption of AI, are increasing the challenges statisticians face. In future, official data series may be less reliable, more volatile, and more prone to revision.

- We also advocate users consider a wider variety of sources, such as our sentiment-based nowcasts, to understand where the risks in official data lie.

GDP data is consistently showing a Q3 slowdown after strong H1s

Our own macroeconomic forecasts are dependent on these ONS series as inputs – a key principle of our methodology is to use official data as it’s published to maintain consistency. However, we aim to be clear in our accompanying commentary if we believe there are doubts about the validity of the data, and to use an array of alternative data – including those we have developed with Penta and Data City – to assess where the risks lie.

Tags:

Related Reports

Tariffs take a toll despite easing trade hostilities

Global tradeflows remain under pressure despite easing tariff tensions. Recent US–China agreements reduce select import taxes and support China’s 2026 outlook, yet US imports continue to fall and supply chains pivot toward Asia and Europe. Containerised trade is set to expand, while bulk shipments soften alongside weaker industrial demand.

Find Out More

Global trade is losing momentum

Trade disruptions spread across autos and pharma sectors, with EU tariff exemptions giving Europe a competitive edge amid global slowdown.

Find Out More

Why have China’s exports held up so well under higher US tariffs?

China's exports have adapted, rather than retreated, under higher US tariffs. It will be difficult for businesses and consumers to decouple from Chinese exports or China-linked supply chains.

Find Out More

ASEAN growth opportunities following US-China Tariffs

Using sectoral production data from Oxford’s Global Industry Service, we have been able to quantify which countries and sectors have the greatest potential for production migration. Applying this framework across Asia reveals meaningful industrial depth in Vietnam, Thailand, and Malaysia in trade-intensive segments, and a distinctive, more resource-heavy footing in Indonesia and India.

Find Out More