Trump’s tariffs will likely exacerbate the slowbalisation globally

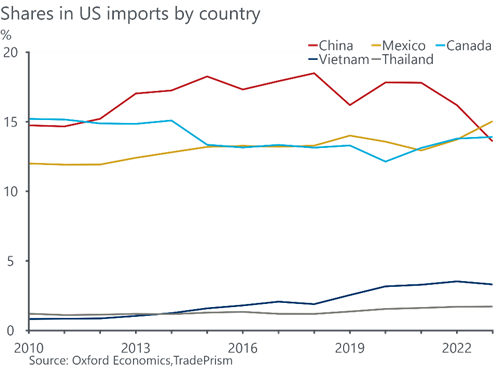

Our latest economic forecasts assume Trump will impose a 30% across-the-board tariff on Chinese imports into the US, a 25% tariff on selected goods from Europe including steel, aluminium, and automobiles, and a 10% tariff on selected goods in Canada, Mexico, Japan, South Korea, and Vietnam. This would take the effective tariff rate on US goods imports to around 6% from 2%.

What you will learn:

- Donald Trump’s victory in the US elections heralds a potential upheaval in global trade. We don’t know exactly what tariffs Trump will enact, but his campaign rhetoric and his political appointments so far suggest he will implement significant changes to policy.

- From Trump’s first term, we’ve learnt that trade wars affect a broad range of goods, not just those facing tariffs. So, the hit to trade outside of China may extend beyond the selected goods on which we expect tariffs will be applied.

- New tariffs on China would intensify its decoupling from the US which has already been building over the past eight years. On top of this, the inclusion of Asia in the next phase of tariffs would limit the ability to reduce the hit from higher tariffs by rerouting trade. Consequently, we think Trump 2.0 will add to the slowbalisation that is already taking place.

- We expect Trump’s tariffs will reduce global trade values by more than 7% by 2030 compared to our pre-election forecasts. By contrast, we only anticipate a modest 1.8% hit to nominal GDP over the same period.

Tags:

Related Posts

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

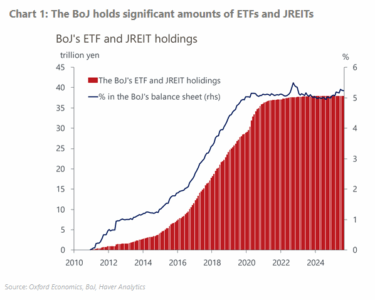

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More