Japan’s shock election defeat for the LDP, but policy shift unlikely

The ruling Liberal Democratic party and its partner Komeito lost their majority in Japan’s lower house elections on Sunday, which means the two parties will likely be forced to manage the government as a minority ruling coalition.

What you will learn:

- Despite the febrile political situation, we don’t intend to change our forecasts at this point because the LDP’s wage-driven growth strategy has broad support among opposition parties.

- The Prime Minister Shigeru Ishiba has committed to maintain the economic policy framework of the previous administration. Under greater political pressure, we expect he will focus on pro-growth and market-friendly policies that support vulnerable households and regional economies. Opposition parties may call for greater fiscal expansion to support vulnerable households. However, we think Ishiba will likely refrain from discussing painful revenue measures.

- On monetary policy, although we still assume the Bank of Japan will hike rates in December, the government could become more cautious about the pace of normalization.

Tags:

Related Posts

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

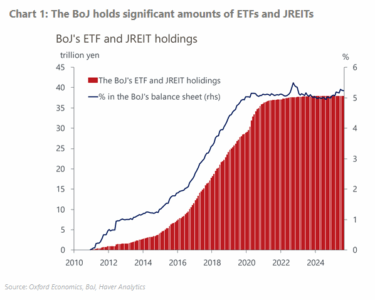

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More