European industry will bottom out and recover…eventually

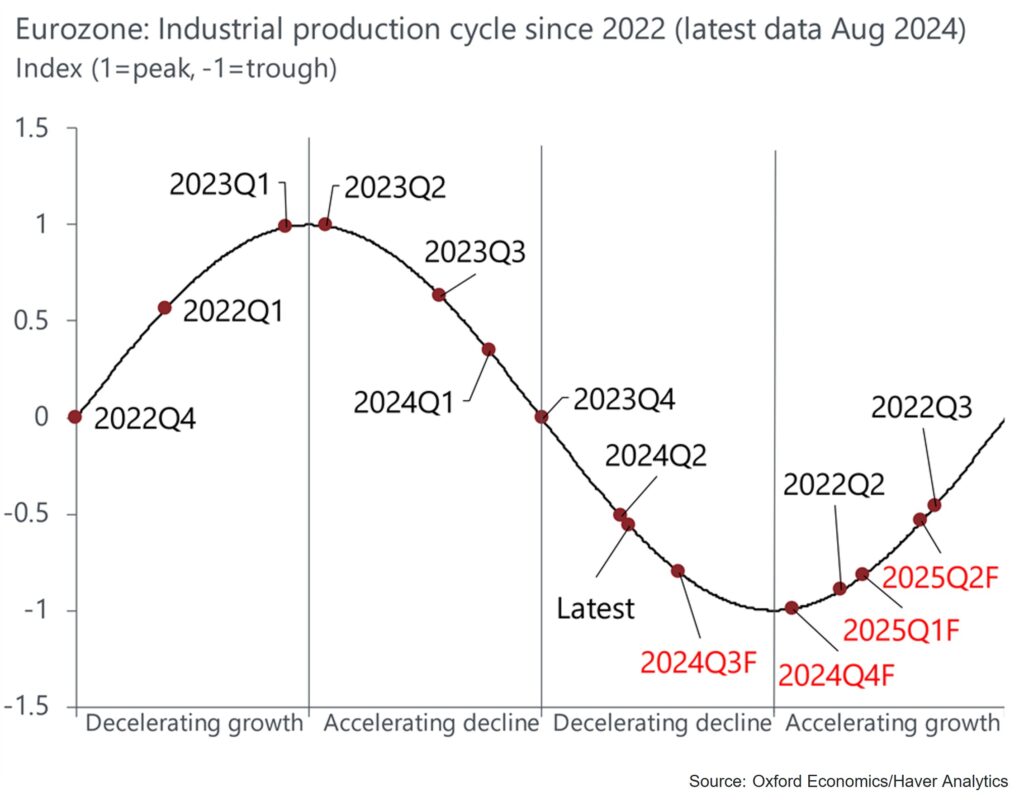

European industry is still in the midst of an almost two-year recession, but we believe that the end is increasingly in sight. Our proprietary business cycle indicator is picking up signs that the pace of decline is moderating which, combined with our forecasts for industrial production, suggests a business cycle trough is approaching.

What you will learn:

- Our latest estimate shows output bottoming out towards the end of this year or beginning of next, setting the stage for an industrial expansion across 2025.

- Falling gas and electricity prices have already provided a boost to energy-intensive sectors, which are at the forefront of growth currently. However, the smaller reach of these sectors means that the broader industrial recovery will have to wait for the effect of interest rate increases to filter through to the real economy, for the inventory cycle to turn, and for consumers’ appetite for goods spending to fully return.

- The risks to our current forecast are firmly on the downside. Weakness in industry has been correlated strongly with weakness in the broader economy, and the eurozone economy has consistently defied expectations it would begin bouncing back.

Tags:

Related Resources

Post

Industry key themes 2026: Industry will grow if you know where to look

Prospects appear solid for global industry in 2026, but activity is set to remain regionally and sectorally divergent.

Find Out More

Post

Australia’s Infrastructure Outlook: Big Shifts, Bigger Challenges

Australia’s infrastructure landscape is shifting fast, driven by new investment trends, emerging asset classes and growing capacity constraints. This outlook explores the major changes ahead and what industry and government must do to navigate the decade effectively.

Find Out More

Post

Peak tariff impact on industry still to come

In 2026, we anticipate global industrial value-added output to grow just 1.9%, the slowest pace of growth since the global financial crisis.

Find Out More