Japan’s rising labour turnover will raise productivity, but only slowly

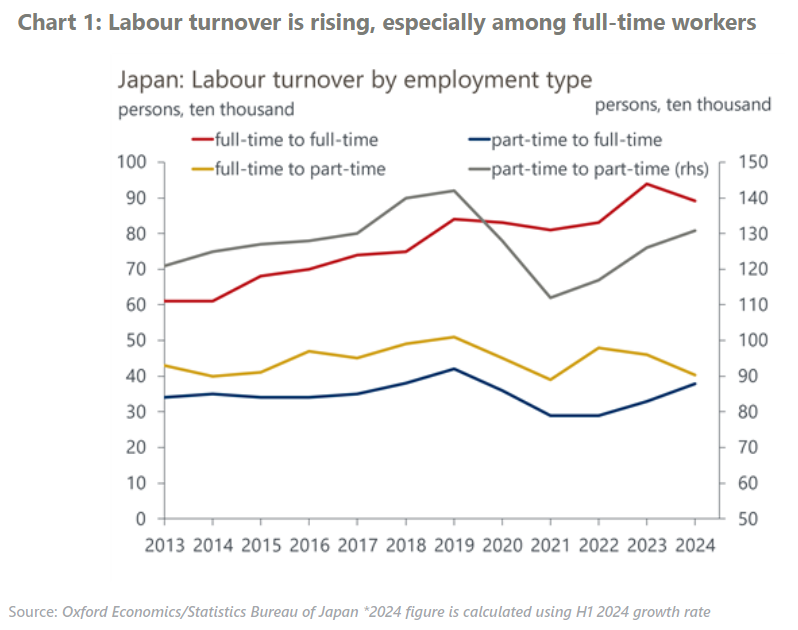

Labour turnover is quickly rising among full-time workers in Japan, where long-term employment has been prevailing. Although a serious labour shortage and a sharp rise in labour turnover will provide a great opportunity and incentive for productivity improvement, we this this will occur only gradually.

What you will learn:

- Rising labour turnover, especially among young workers, has enhanced the ongoing wage-driven inflation process by changing the employment system in Japan, which has been characterized by the combination of long-term job security and a rigid seniority-based wage scale.

- Within same industries, employment has shifted from small firms to large firms. This change in the distribution of labour will likely accelerate as unprofitable small firms fail. The shift will raise productivity in those industries where the gap in productivity between large and small firms is significant.

- But progress in the reallocation of labour through turnover across industries has been limited. Changes in the share of labour input by industry have made only a modest positive contribution to overall productivity growth and its impact has become smaller in recent years.

- Labour turnover across industries will rise, but only gradually because it requires re-skilling of workers and the reallocation of workers across regions. Despite some positive impact from AI, we maintain a cautious projection of long-term productivity growth in Japan.

Tags:

Related Posts

Post

Japan’s fiscal policy will remain loose, which increases risks to debt sustainabilit

We've changed our fiscal outlook for Japan in our December forecast round. We now expect the new government to set a primary deficit close to that of 2024, at 2%-3% of GDP for 2025-2027, instead of restoring a balanced budget by taking advantage of strong tax revenue. We assume higher bond yields will force the government to take measures to reduce the deficit from 2028.

Find Out More

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More