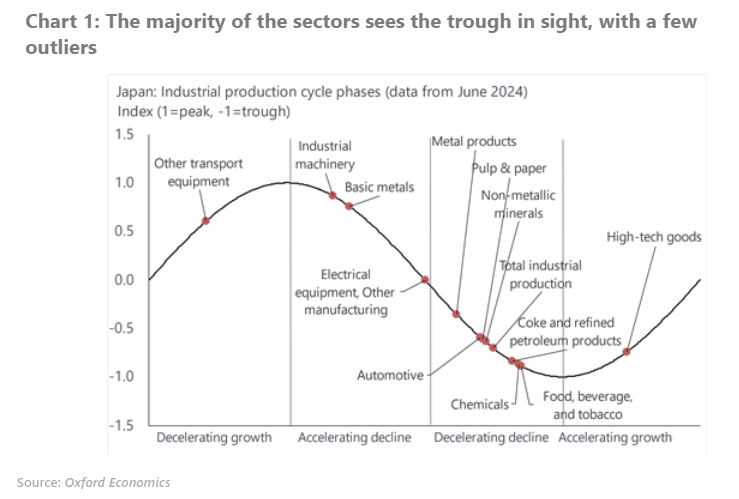

Japan’s industry nearing the trough, with high tech leading the way

Our new proprietary business cycle phase indicator points to a trough in sight for industry, but with dispersion among sectors. High tech is leading the pack with output firmly on its way up. While most other sectors have yet to reach a cyclical trough, we believe they are now closing in.

What you will learn:

- Output of high-tech goods has been growing since the beginning of 2024 largely thanks to higher semiconductor production, notably bucking the downward trend across much of industry. We see momentum only strengthening from here, and at 4.1% growth for 2024, the industry is forecast to be one of the fastest-growing manufacturing sectors this year.

- Industrial machinery is on the other side of the spectrum, as it appears the slowdown since the end of 2022 is set to intensify. The softness is apparent across the board but is more pronounced in subsectors such as metal forming machinery, where a long inventory adjustment process appears inevitable.

- The auto sector’s position in the phase indicator is heavily distorted by the recurrent production stoppages stemming from the safety testing scandal. Absent these distortions, the sector would most likely be in the decelerating growth or accelerating decline phase.

- Chemicals have been declining since early 2022 due to higher energy prices but the turning point is close. The gradual appreciation of the yen will lower energy costs and support profit margins, although tighter monetary policy and the destocking cycle will keep growth in check.

Tags:

Related Posts

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

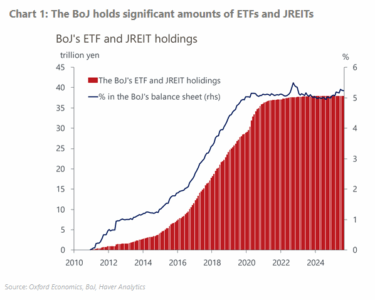

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More