What would be the implications of tariffs on Chinese EVs?

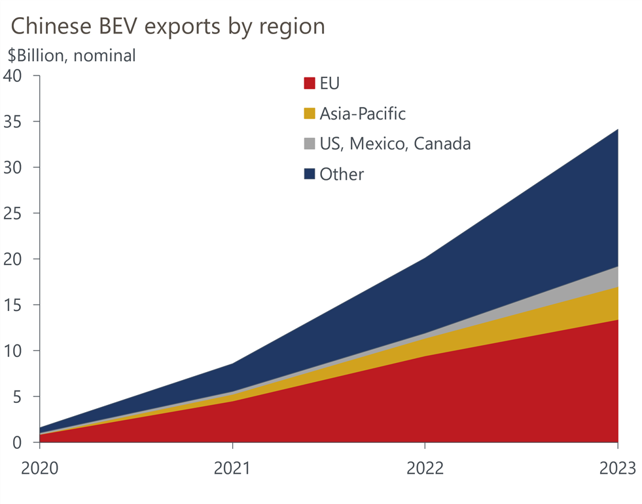

Announced tariff increases by the US and EU on made-in-China EVs, if implemented, will increase EV prices and reduce demand. This will slow the adoption of EVs globally, to the detriment of the energy transition.

What you will learn:

- The US tariffs—to be raised from 25% to 100% in August—are prohibitively high and will discourage inflows of cost-competitive Chinese EVs that would lower prices for US consumers.

- The EU tariffs range from 27.4% to 48.1% and have been applied on a firm-specific basis, though they are provisional and could be scrapped following EU-China negotiations. Many local Chinese brands earn significant profits on their EU sales and have the capacity to absorb the tariffs. In these cases, prices will likely increase, but not substantially. But for foreign brands using China as a manufacturing hub for export to the EU, the tariffs are likely to significantly erode profitability.

- Retaliatory measures by the Chinese government are set to be defensive in nature and focus on mild targeted tariffs and currency offsets.

- Our Q3 Global Industry Service forecast update, being released in early September, will include the expected impacts of the tariffs on EV sales and production regionally and globally. You may request a trial of our service here.

Tags:

Related Resources

Post

A reality check on the status of RMB internationalisation

The recent geopolitical shocks and abrupt US policy shifts have heightened concerns about the stability of the dollar-centric global financial system and strengthened the perceived need for diversification.

Find Out More

Post

China and AI underpin stronger global trade outlook

Global trade is set for a stronger-than-expected rebound, supported by lower US tariffs, continued AI-driven investment, and China’s renewed export push. Our latest forecasts show upgrades to both nominal and volume trade growth in 2025–26, even as legal uncertainty surrounding US tariff mechanisms and evolving geopolitical dynamics pose risks to the outlook.

Find Out More

Post

Tariffs take a toll despite easing trade hostilities

Global tradeflows remain under pressure despite easing tariff tensions. Recent US–China agreements reduce select import taxes and support China’s 2026 outlook, yet US imports continue to fall and supply chains pivot toward Asia and Europe. Containerised trade is set to expand, while bulk shipments soften alongside weaker industrial demand.

Find Out More