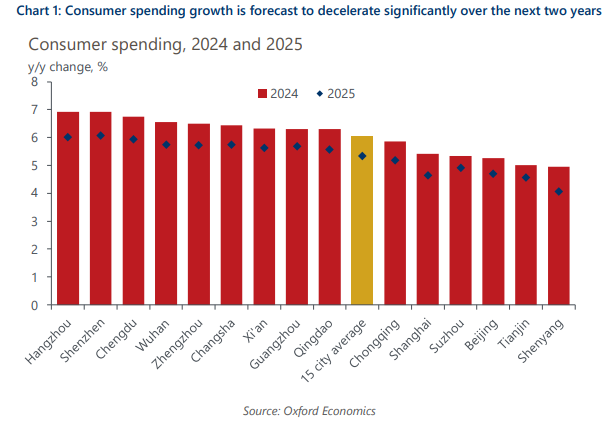

Chinese City consumers weighed down in 2024-25

We expect labour market and income growth outcomes to be the main determinants of the variation in spending growth outcomes across China’s cities over 2024-2025. Shenzhen and Hangzhou, two of China’s most dynamic cities, lead our forecasts for income, employment, and consumer spending growth over the next two years.

What you will learn:

- GDP growth is forecast to slow over the next two years across most major Chinese cities, with consumer spending expected to be a key area of weakness for many. The outlook for spending growth in Chinese cities hinges on the teetering risk of entrenched deflationary pressures, the impacts of the ongoing property market downturn, and each city’s own economic, demographic, and labour market strength.

- The risk of entrenched deflation has been growing over the past few months as CPI readings, especially for consumer goods, remain persistently negative. This could hamper the spending outlook if consumers start to delay their purchasing decisions. Big-ticket discretionary purchases, such as household appliances, would likely be significantly affected—although the government has recently launched a trade-in program to try and stimulate demand in these areas.

- The ongoing property market downturn appears to have some distance left to run and continues to weigh heavily on consumers through its substantial negative wealth effects and impacts on consumer confidence. However, the downturn has not affected cities equally. Residents in some of China’s largest and most prosperous cities, such as Beijing and Shanghai, have so far experienced a slightly shallower contraction in house prices, and by extension, consumer confidence.

Tags:

Related Reports

Post

The rise of Southern India’s business service hubs

Over the next five years, India is set to be one of the fastest-growing major economies across Asia Pacific, lead by the performance of its IT and business services. The Southern states of Karnataka and Telangana are at the forefront of this success as they are home to two of India’s most rapidly growing cities and productive cities—Bengaluru and Hyderabad.

Find Out More

Post

London’s productivity slump highlights Manchester’s momentum

The UK’s productivity performance has been lacklustre since the 2008 global financial crisis—both historically and relative to its international peers.

Find Out More

Post

Amsterdam outlook 2025-2029

The European economy has endured a challenging year in 2025, but we expect Amsterdam to hold up relatively well.

Find Out More