Research Briefing

| Jun 12, 2024

Chartbook: In search of Europe’s next logistics star city

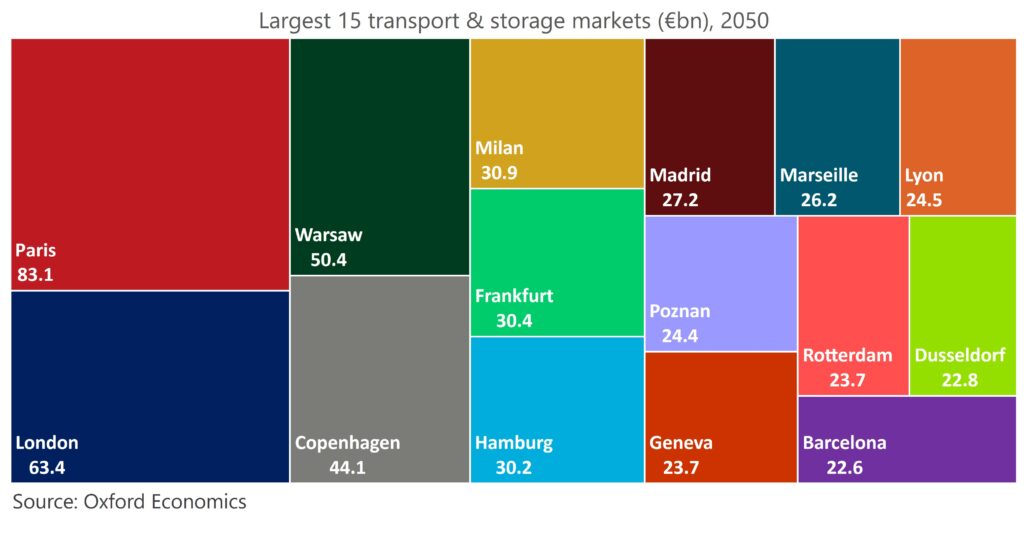

Europe’s 100 major cities account for almost 50% of transport & storage GVA in Europe, equating to €536 billion in 2023. By 2028, this figure is projected to rise by 22% to €656 billion, before surpassing €1 trillion in 2050. In our latest European Cities Logistics Chartbook, we share the following insights:

- Sector resilience: The transport & logistics sector displayed some resiliency during 2023. We estimate that growth in the sector slightly outperformed that of GDP over the past year.

- Leading logistics hubs: Paris and London are Europe’s largest centres for transport & storage, collectively generating €55.1 billion in GVA in 2023. As a share of total GDP, Copenhagen’s economy is the most reliant on the logistics sector.

- The biggest climber: Warsaw will be Europe’s biggest climber. It is currently Europe’s 17th largest logistics centre for GVA. But by 2050, the Polish capital will sit in 3rd place.

- Risks for Europe’s logistics centres: There are, however, several challenges facing Europe’s logistics hubs, including efficiency disruptions from recent onshoring trends, labour shortages in cities, and the need to decarbonise.

Tags:

Related Reports

Click here to subscribe to our real estate economics newsletter and get reports delivered directly to your mailbox

Real Estate Key Themes 2026: CRE deal recovery delayed, not derailed

Real estate is still poised for a revival in 2026. Although 2025’s deal recovery was delayed, the key fundamentals remain in place for renewed momentum.

Read more: Real Estate Key Themes 2026: CRE deal recovery delayed, not derailed

Inflation and bond yield shocks in Europe affect RE returns the most

Our modelling shows European real estate is most exposed to inflation and bond-yield shocks, with impacts varying widely across cities and sectors.

Read more: Inflation and bond yield shocks in Europe affect RE returns the most

2026 US real estate supply outlook

Explore how shifting supply trends are shaping industrial, office, retail and residential real estate in 42 US metros. Download our infographic today.

Read more: 2026 US real estate supply outlook

Real Estate Trends and Insights

Read more analysis on real estate performance and location decision-making.

Read more: Real Estate Trends and Insights[autopilot_shortcode]